Moving past the incumbent vs challenger narrative to forge new business models and sustainable finance.

This is part five of the series on the History of Fintech. Read part one, part two, part three, and part four.

In his 2015 letter to shareholders, JP Morgan CEO Jamie Dimon warned that, “Silicon Valley is coming. There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking.”

He was right, of course. In the years following, fintechs sprang forth in almost every area of finance, fueled by massive amounts of VC financing.

Still, the massive upheaval to the banking industry hasn’t quite hit yet — at least not in the way fintech disruptors threatened. Banks are still the leading institutions for issuing credit, depositing and investing money, and act as gateways to global payment systems.

The inevitable fintech disruption, then, will not be in the form of toppling major banks. Rather, it’s a forced evolution, in which banks adopt or adapt to new forms of working, embrace strategic partnerships, and fight for the best talent in both tech and finance.

The question isn’t “what,” it’s “how” and “who”

Fintechs may have enjoyed an advantage as first movers and agile developers, testing consumer interest and experimenting with new business models — but at the end of the day, large financial institutions have the power to acquire, partner, or simply build in-house whichever solutions seem destined to win in the market.

For banks to stay ahead of the curve, though — rather than wait, see, and react — they need to look not at what fintechs are doing, but how they’re doing it.

One of the ways fintechs are able to beat banks on pricing is through their streamlined approach to product development and request fulfillment. By building leaner, more automated processes from the beginning, fintechs have been able to avoid some of the bloat that large banks struggle with.

Should banks view fintechs as a cause for rivalry or collaboration? Read why we think both can thrive in the world of finance if they join forces.

As one analyst put it, “banks need to learn from the fintech revolution by structuring their organizations around how to provide flexible solutions to problems instead of siloed teams working within linear product mandates.”

The lasting impact fintechs may have on the financial industry is deeper than any one technology — it represents a shift in how institutions organize themselves. And to make that change possible, financial institutions need to hire like fintechs.

Recruiting the right people

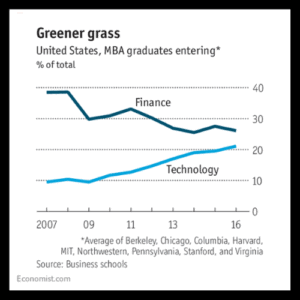

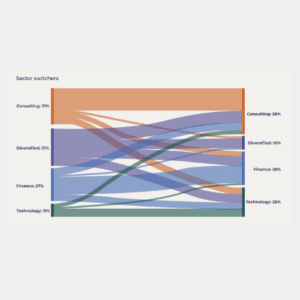

Over the past decade, the number of new college graduates entering finance has declined as tech becomes an increasingly attractive — that is, lucrative — choice for new hires.

In 2007, almost 40% of all MBA students from top schools in the US were looking for jobs in the finance industry, compared to just over 10% seeking work in technology. By 2020, those numbers had almost inverted, with more tech companies officially hiring MBAs than financial companies.

Even when the salaries are better, many graduates aren’t interested in working in finance. Among the 2021 graduating class of London Business School, 26% said they were pursuing careers in finance. However, 27% of that same class had previously worked in finance, suggesting a slight decline in interest overall, despite offering some of the highest salaries. Those who veered away from finance were most likely to choose tech or consulting as their alternative.

As the Great Resignation continues, employment norms are shifting, and large financial institutions need to keep apace with worker expectations, both in terms of compensation, culture, and emphasis on technology.

People want to work with the latest tech, and finance offers many opportunities for creative programmers. But banks and other financial institutions need to adopt a tech-first approach to development, bringing technologists into all areas of decision making instead of siloing them into IT departments, support teams, or incubators.

Reinventing the rails — together

Gartner Research predicts that by 2030, 80% of “heritage financial firms” will no longer exist, having been fully commoditized or relegated to “zombie status.”

This potential future has a lot to do with the limitations of the underlying infrastructure that banks and other financial institutions depend on. These “rails” dictate many of the technical and regulatory restraints banks must operate within, but they are there for a good reason, supporting standardization and interoperability in our global financial systems.

Until now, both fintechs and established financial institutions have been, if not equally then at least proportionally, dependent on these industry standards.

Find fintech partners without the long wait times or technical risks. Speak with a United Fintech consultant and we’ll help match your requirements with ready-to-go solutions. Book a free demo.

However, the world of fintech — and especially the growing ecosystem of blockchain technology — is looking for ways to circumvent the rails altogether. Decentralized finance (DeFi) is a proposed new financial framework based on blockchain protocols that would make financial products and services accessible to users without the need for a centralized authority like a bank or government-backed currency.

But while the promises of DeFi — and the related investments and partnerships — are sky high, it’s still a risky proposition with an uncertain future. The stablecoins on which DeFi is dependent have plunged recently, reminding incumbents and challengers alike that we are entering uncharted territory.

The future of (re)banking

Fintech may not be imminently poised to overcome traditional banking any time soon, but it is definitely still growing. The global fintech market is expected to reach almost $310 billion in 2022, representing an annual growth of 24.8%.

And with emerging applications for technologies including AI and machine learning, biometric identification, the Internet of Things, autonomous finance, and smart contracts, not to mention the continued dominance of mobile banking, virtual cards, crypto-trading, and more — it’s clear that the role of tech in finance is getting both deeper and broader.

We started this series by talking about “experimental unbundling” — the process in which fintech startups focused on niche service areas in an attempt to differentiate themselves with better customer service, more modern branding and messaging, and competitive pricing models.

The logical result of success in this endeavor, however, is a market saturated with niche players, each competing for the same customer base, and dependent on open access between accounts. In the US, consumers using fintech in 2021 grew to 81% up from 58% the previous year, with 76% saying that “connectivity was a top priority in choosing a bank.”

It seems likely that consumers will soon grow weary of maintaining separate accounts for different financial services, preferring instead to consolidate and simplify their access with the institution that offers the best of both worlds.

The only question that remains is if that will be a fintech that looks like a bank, or the other way around.

About United Fintech

United Fintech offers the best fintech products on one central platform. We enable banks and financial institutions to access innovative digital technologies — including real-time data, trading charts, and financial news — by partnering with engineering-led fintech companies with proven capital markets products.