Companies

Products

Fair Value Pricing

Independent fair value pricing for added transparency where current prices are not readily available

The right data and tools for your trading and investment needs

One connection to global, multi-asset analytics, news and insights

Flexible solutions, comprehensive market data and services

Innovative, efficient, buy-side workflow automation solutions

All the data required for reporting and enhanced compliance

Digital solutions for a premium client experience

Enterprise-wide digitalization through a single platform

One platform, end-to-end digital transformation

Keep pace with technology, exceed customer expectations

Monitor, measure and maximize value

Quality, multi-asset data and analytics from a single vendor

'One stop' smart access to global trading and market data

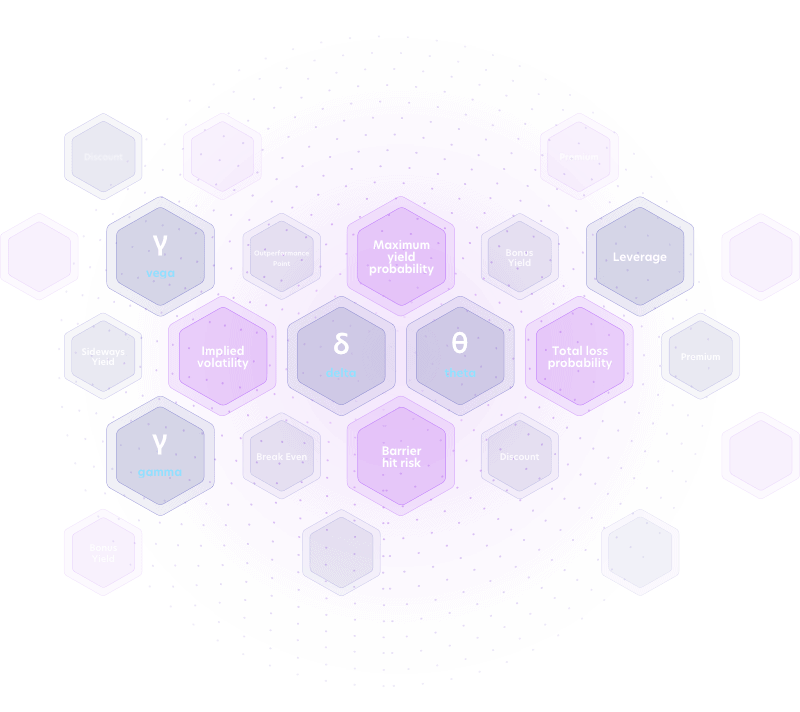

Key Figures & Risk Indicators

key figures

structured products

With more than 100 key figures for a wide range of payoff types and more than 1.8 million existing structured products, we’ve got you covered. All key figures are updated in real-time to provide your clients with valuable information that others don’t have.

Key Figures and Risk Indicators

Our key figures include sophisticated ones such as the Greeks, the Barrier Hit Risk, Maximum Yield Probability, and Implied Volatility. Our industry-standard computation methodologies are based on our proprietary estimates for volatility surfaces and dividend forecasts - that’s what makes them so reliable.

Increase the traffic on your website by offering valuable information that others don’t provide.

Get more users to place an executable order.

Help your clients select the products that best suit their risk appetite.

Reduce the time it takes for your clients to identify the most suitable products.

Manufacturers of structured products don’t need to operate their own infrastructure - we manage the entire issuance process of their product and beyond.

Simon Ullrich, Founder & Head of Business Development at TTMzero

Shape the digital future for financial institutions

together with United Fintech and our partner companies.