Companies

Products

Fair Value Pricing

Independent fair value pricing for added transparency where current prices are not readily available

The right data and tools for your trading and investment needs

One connection to global, multi-asset analytics, news and insights

Flexible solutions, comprehensive market data and services

Innovative, efficient, buy-side workflow automation solutions

All the data required for reporting and enhanced compliance

Digital solutions for a premium client experience

Enterprise-wide digitalization through a single platform

One platform, end-to-end digital transformation

Keep pace with technology, exceed customer expectations

Monitor, measure and maximize value

Quality, multi-asset data and analytics from a single vendor

'One stop' smart access to global trading and market data

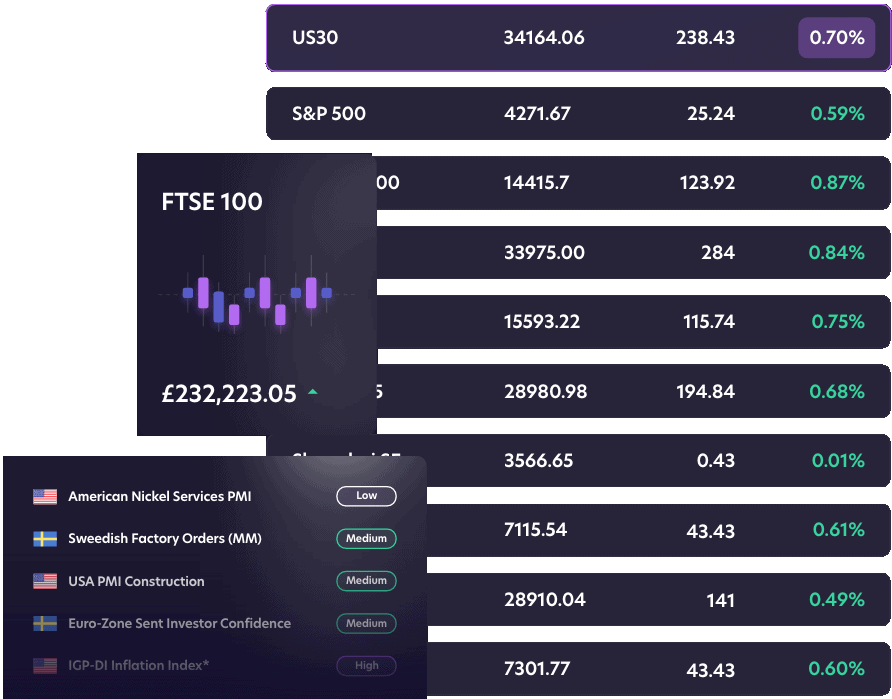

The global stock market is both complex and volatile. Tiny changes can happen in mere milliseconds but have huge financial implications. Traders, hedge funds, and investors must therefore keep a close eye on the stock market to make effective decisions.

Stock market APIs---or simply “stock APIs”---help with this task by providing users with relevant, accurate, and up-to-date stock market data, often in real time. That’s why stock APIs are seeing increasingly widespread use within the financial sector.

“API” stands for “application programming interface” and refers to code that lets two separate software platforms “talk” to each other. More specifically, APIs help one application tap into a data source made available by another.

In the context of the financial market, stock APIs typically parse and compile relevant stock data from multiple sources into an accessible format that lets users easily monitor the data or incorporate it into their own tools for further use. This usually involves stock price data but can also include a whole range of other details about stock market indices.

Using stock trading APIs massively speeds up and streamlines data collection, as investors and brokerage companies would otherwise have to spend time pulling the needed information from many separate sources.

Generally speaking, there are two broad categories of people who will care about stock data APIs, for different reasons.

Developers will frequently be tasked with creating a tool for someone else to use. This might be:

For all of these purposes, developers will need access to accurate data, which is exactly what trading APIs provide. It’s easier to use an off-the-shelf stock price API than find a way to compile the various data sources on your own.

End users: Making financial decisions

The typical end users of stock market data are traders, investors, brokerage firms, and the like. They simply want a ready-made tool that facilitates their decision-making by giving them relevant financial information. Investors must have confidence that the tool in question uses a solid data source, and knowing that it is based on a reputable API is the safest way to ensure that.

For traders, the primary benefit of stock market data is the ability to make faster and better decisions. The reasons stock market data APIs excel at supporting this are:

1. Ease of setup

By their very nature, APIs are essentially plug-and-play interfaces. They don’t require complex coding and will seamlessly bridge the gap between different software platforms. This makes them easy to roll out and integrate.

2. Data aggregation

Stock tracking APIs can parse and consolidate data from thousands of sources, in the exact way a trader might want it. This is a feat that’s impossible to replicate manually.

3. Scalability

Whether a trader needs access to a niche subset of data or the entire global market, the right stock API can provide it. It’s simply a matter of selecting the most relevant APIs for your specific needs.

4. Customizability

With access to developers, traders can easily shape APIs to their purposes. They can start with an off-the-shelf API and modify it to extract the exact insights they need.

5. Peace of mind

Finally, reputable APIs provide investors with the much-needed confidence in the quality of the data they’re getting. This lets them worry less about the data itself and focus instead on the financial decisions this data supports.

But what makes a stock API reliable and how do you pick the right one for your needs?

The stock API you select will depend heavily on your exact requirements. As such, finding the best one for your needs is a matter of asking the following questions.

What is its data source?

Stock APIs vary in terms of the types of data they provide and the data source itself. You’ll want to pick a stock data API that pulls the exact information you need from a legal and trusted source.

Is there a latency?

If your job involves split-second decisions, you’ll want an API that has as little delay as possible in delivering live data to you. If speed is less critical, you can usually afford to work with a higher latency API.

What is the APIs’ market scope?

Decide whether you need data from a single stock exchange or aggregated details from multiple sources. This will determine the market scope of the API you’ll be choosing.

What time horizon does the API cover?

Some stock APIs provide live data to support real-time decisions. Others deliver data that’s delayed by a number of minutes. You can also find APIs that dissect historical data to predict future trends. Keep in mind that real-time data tends to cost much more. Picking the stock API is therefore a matter of balancing affordability with your organizational priorities.

How does the stock API treat currency conversion?

This isn’t an issue if you’re focusing on a single geographical region. But if your stock exchange API works across markets, you’ll want to look at how it deals with currency conversion.

Does it convert all stock prices into a single currency? Which one? At what point does this conversion happen? If you want a specific, consistent picture of the stock market, you’ll have to pick an API that supports that view.

How is the API priced?

As mentioned, real-time data often comes at a premium. But API providers will also have different pricing models. Some will cap the amount of data requests you can make in a time period, charging you extra for additional ones.

You can find API providers with flexible pricing that let you pay for needed features as you go. Enterprise-grade providers may sell all-in-one packages with a long binding period. As always, your needs will dictate what you’ll go for.

Is the API technically sound?

This is a broad category that tends to be more relevant for developers. Here, it’s often important to know:

NetDania: Robust and high quality data via API

One of United Fintech's portfolio companies, NetDania, provides both data and software for market professionals. With an excellent product range that serves some of the world's largest financial institutions, NetDania is the ideal platform for any trading professional. The platform provides market data, APIs, market terminals, and charting components on both desktop and mobile.

To learn more about NetDania's stock API solution, click on the product(s) below:

Shape the digital future for financial institutions

together with United Fintech and our partner companies.