Companies

Products

Fair Value Pricing

Independent fair value pricing for added transparency where current prices are not readily available

The right data and tools for your trading and investment needs

One connection to global, multi-asset analytics, news and insights

Flexible solutions, comprehensive market data and services

Innovative, efficient, buy-side workflow automation solutions

All the data required for reporting and enhanced compliance

Digital solutions for a premium client experience

Enterprise-wide digitalization through a single platform

One platform, end-to-end digital transformation

Keep pace with technology, exceed customer expectations

Monitor, measure and maximize value

Quality, multi-asset data and analytics from a single vendor

'One stop' smart access to global trading and market data

On the face of it, trading in options sounds relatively straightforward. If you can successfully anticipate the price of the underlying stock at a given future date, you can exercise your option to earn money.

But options come with a literal price, called a “premium.” If you’re to actually make a profit, the money you make from exercising your option should also cover the premium you’ve paid for it.

So how exactly do you evaluate whether an option is worth purchasing at its current premium? By using the option Greeks, of course.

Named after the Greek letters used to denote them, option Greeks are calculations that help traders quantify the impact of various factors on an option’s premium.

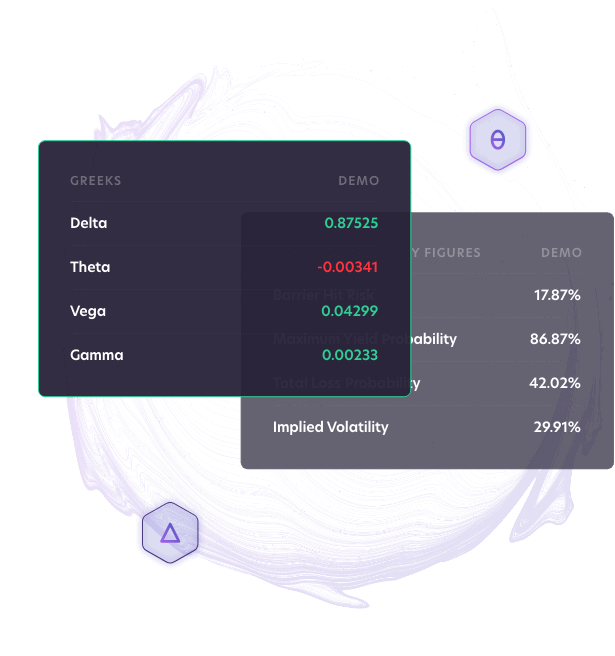

While professional traders use many different Greeks, the following 4 major ones are considered “must know” for anyone starting out with options trading:

Put simply, Delta indicates how much an option’s price is expected to change when the price of the underlying asset itself changes. A Delta of 0.30, for instance, means that the option’s premium is predicted to increase 30 cents for every dollar change in the price of an asset it’s linked to.

Because Delta is so important, traders want to keep an eye on how the Delta itself may respond to stock price changes. This brings us to the next Greek: Gamma.

Delta is a static snapshot. But as the price of the asset changes, so will the Delta of the corresponding option.

Gamma is used to calculate this sensitivity of Delta to the change in price of the underlying asset.

Theta measures the expected change in an option’s premium as it gets closer to expiration.

Generally speaking, the closer the option is to expiring, the lower its premium. That’s because there’s less time left to exercise the option at a profit. This is often referred to as “time decay.”

Vega relates to the implied volatility of the underlying stock. It measures how sensitive an option’s premium is to potential stock fluctuations.

Since a high Vega indicates less predictable future outcomes, it will result in the rise in the premium of an option.

If you’d like to better understand the four primary Greeks, we’ve already covered them in more detail.

Rho predicts how the changing interest rates may affect an option’s price. Rho doesn’t always make the list of primary Greeks. That’s because day-to-day interest rate fluctuations typically don’t have a major impact on option prices.

However, if your strategy depends on trading in options that are especially sensitive to interest rates, you’ll definitely want to pay more careful attention to Rho.

The lesser Greeks delve even deeper into the nuances of options trading. If you’re a serious trader, you’ll likely find them relevant for different reasons. Here are some of the lesser option Greeks and what they measure:

Zomma: how volatility affects Gamma.

Despite the many intricacies outlined above, the main purpose of knowing the Greeks comes down to one thing: making smarter decisions when trading in options.

More specifically, the Greeks can tell you whether the current premium you’ll pay is likely to be offset by exercising the option at a future date.

In short, mastering the Greeks makes you a better option trader. Together, they can help you decide which options to buy, when, and at what premium.

The more you know about how the Greeks work, the more accurate your future predictions will be and the more profit you can extract from exercising your options.

In principle, all Greeks are really measures of risk that always come with betting on uncertain future outcomes. Dismissing the Greeks when trading in options is essentially equivalent to gambling.

Just as you wouldn’t buy a house without knowing whether its price is reasonable, you shouldn’t purchase options without first having some idea of how their premiums are calculated and how they’re likely to develop.

In the worst case, you stand to lose a lot of money buying options that consistently expire without you ever getting to exercise them.

You could certainly learn the formulas for all of the main Greeks and calculate them on your own.

However, not only is this a time-intensive activity, it’s also completely impractical. As a trader, you’ll likely be dealing with a dozen different, ever-evolving options on any given day. Keeping track of them with pen and paper isn’t exactly the best use of your time.

Luckily, you don’t have to. Most brokers that list options will also provide handy tables with calculations for all of their main Greeks. This makes it easy to compare options side-by-side and make informed decisions.

If you’re heavily involved in options trading, it may make a lot of sense to invest in software that makes your job easier. The benefits of using such software is that you can often customize how and which key figures it displays, based on your individual preferences.

Instead of e.g. consulting the different Greek values from brokers and pairing these manually with other important indicators, you can create your own custom reports that put all of this data into a single actionable dashboard.

You can certainly find off-the-shelf financial software that has option Greeks calculations built-in by default. This lets you spend less time chasing accurate numbers and instead focus on making profitable trades.

Just make sure you know exactly what all of those Greek values mean before you dive in!

TTMzero: Automated solutions for capital markets

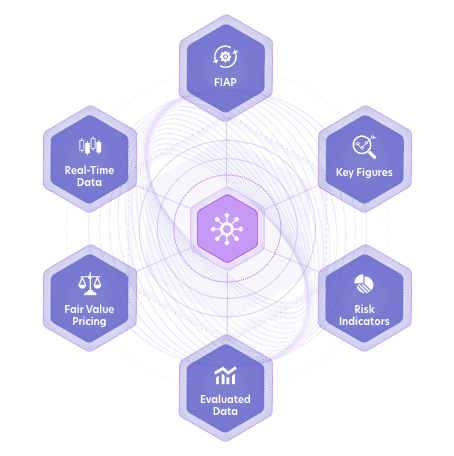

One of United Fintech's portfolio companies, TTMzero, provides high-quality real-time data and fully digitized regulatory and capital markets tech solutions that take clients into a new digital era.

To learn more about TTMzero's solutions, click on the products below:

Products

Key Figures and Risk Indicators

TTMzero calculates about 100 key figures for structured products, including the Greeks and risk indicators, which provide precise risk and return probabilities.

Explore product

Financial Instruments Automation Platform

Digitize your issuance processes with TTMzero’s Financial Instruments Automation Platform (FIAP) to allow for a fast market launch of new products and ensure straight-through workflows. Also includes PRIIPs for KIDs.

Explore product

Shape the digital future for financial institutions

together with United Fintech and our partner companies.