Let’s take a journey to the past… the year is 1999.

The Matrix has just hit movie theaters. Microsoft is battling AOL for internet supremacy. And when a company — anticipating a technical revolution — needs new software, they build it themselves.

How things have changed (well, except for new Matrix movies). AOL is no longer the internet giant it was, and thanks to cloud computing and SaaS partners, companies are racing to reduce their dependence on internal IT resources.

Within the financial world, banks and other financial services firms are embracing the rise of fintechs as a source for specialized software, regulation-friendly security, and user-friendly support without building a dependence on costly internal teams and legacy systems.

Legacy systems: when the love is gone

Just like the dot com bubble forced early tech giants to reinvent themselves, the digital transformation heralded by the rise in cloud computing has forced companies to embrace a more agile system of technical development and digital business models.

But the financial world has been slow to adapt to the SaaS model of software procurement, at least in part due to their continued reliance on legacy systems. Unfortunately, many of these systems — which run on increasingly outdated hardware and software — can no longer compete with their cloud-based fintech rivals.

Looking for a partner in digital transformation? United Fintech is here to empower financial institutions to thrive and compete in the digital era.

Modern data and security requirements often preclude legacy systems or require customized integrations to remain in compliance. Additionally, the number of developers and specialists with knowledge in legacy systems is largely declining, as new languages, programs, and protocols replace them in popularity.

Replacing a legacy system is often a complicated and expensive undertaking, but this has to be balanced against the long-term costs of maintaining them. Some companies reportedly allocate up to 80% of their IT budgets to support legacy systems, doubling down on fixed costs instead of looking for ways to become more agile.

To build or to buy? That is the question.

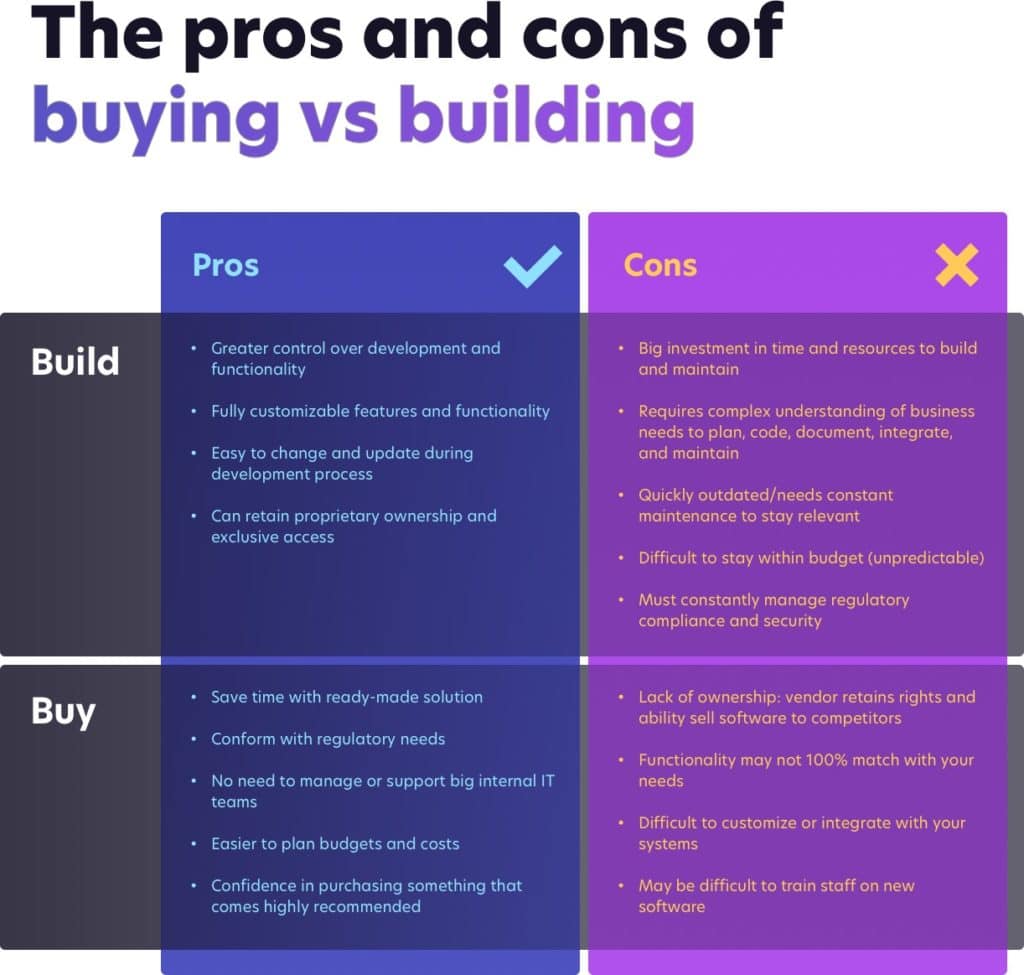

So, the time has come to replace a legacy system — or perhaps to expand into a new service area or market. The question then is whether to reinvest in a new internally-developed system or to seek out a technology vendor that already provides the functionality you require.

Building new software obviously requires extensive internal resources and often takes a long time before showing financial returns. While proprietary systems are fully customizable and may confer a competitive advantage, they also run the risk of becoming Legacy System 2.0 — another growing cost center that requires massive internal investment.

On the hunt for new technology? Here are 50 questions to help you choose the right fintech partner. Learn more

Buying software from a third-party vendor can save massively in both time and budget — as long as you can find a system that meets your requirements for functionality, integrations, and security. Vetting external vendors can also be a tricky process, as it’s hard to make apples-to-apples comparisons in a complex marketplace.

Of course, the decision to build or buy is not strictly binary. Many companies follow a hybrid path, buying what works and building the rest in-house. In 2021, organizations worked with more than 100 SaaS applications on average, and it would be practically unthinkable to consider managing all of that development work internally.

Behind that statistic is the fact that software is becoming so specialized and so easily integrated that no generalist firm could compete with it. Why would you build a messaging tool when you could easily use Slack, Teams, or any one of their competitors?

In the financial industry, access to real-time data, customized payment processing, and settlement (just to name a few) are all specialty areas in their own right. And in this sense, building or buying is too simplistic a framework.

Choosing a hybrid model: strategic partnerships

Somewhere between a vendor relationship and in-house development is the partner model. Fintech partnerships offer more customization and support than the standard vendor model, while avoiding the most costly aspects of building tech in-house.

And for companies who are building an entire fintech ecosystem, it’s more important than ever to have a good process for vetting and onboarding new technology partners.

Find fintech partners without the long wait times or technical risks. Speak with a United Fintech consultant and we’ll help match your requirements with ready-to-go solutions. Book a free demo.

A fintech technology platform can take on some of the responsibilities associated with identifying and contracting with multiple vendors, maintaining and developing the necessary integrations, supporting onboarding, and ensuring ongoing regulatory compliance — essentially acting as both a technology provider and consultant.

Our increasingly digital world is fragmenting into ever-smaller niches of specialization. And just as we rely on fintech partners to build the tech, it’s time to turn to specialists to vet the tech.

About United Fintech

United Fintech offers the best fintech products on one central platform. We enable banks and financial institutions to access innovative digital technologies — including real-time data, trading charts, and financial news — by partnering with engineering-led fintech companies with proven capital markets products.

Learn more at https://unitedfintech.com/