Since 1992, the Swiss Information Providers User Group (SIPUG) has supported market data suppliers and users with the exchange of information and participation in meetings and conferences, namely SIPUGday in Zurich.

At the end of October 2021, Zurich Marriott Hotel was transformed into an energetic ensemble of market data vendors, infrastructure systems providers, fintech innovators, and major banking institutions – all with one goal in mind: to sniff out the latest user-oriented products in the industry and connect with developers of cost-effective and future-proof solutions.

Together with TTMzero and NetDania, United Fintech made its way to SIPUGday to share our knowledge on market data usage – and of course how to reduce costs in that area.

All of the big names in the industry participated

What’s so wonderful about events like SIPUGday is that everybody with a name in the market (and a DACH focus) is represented and gets a chance to catch up with other vendors and customers.

It’s the perfect opportunity to explain your products in detail and discuss customers’ pain points face-to-face with them.

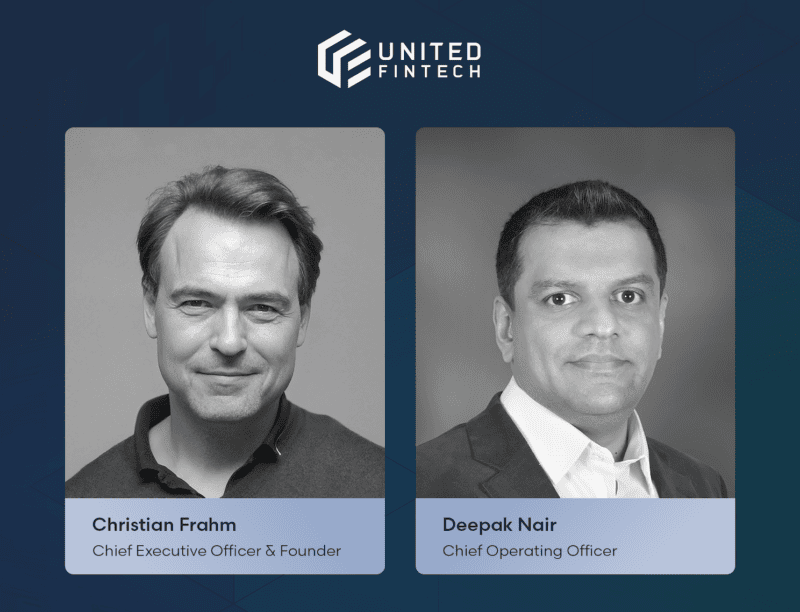

TTMzero’s Co-Founder and Managing Partner, Simon Ullrich, was there along with TTMzero Sales Consultant Juerg Schudel and NetDania’s Co-Founder and CEO, Thomas Elster. We also brought Joshua Green, Senior Sales Manager from United Fintech, and United Fintech’s Founder and CEO, Christian Frahm.

Christian Frahm on innovation in tech

SIPUGday 2021 was based around the theme “trust” with keynotes touching on innovation, technology, security, AI, and more.

United Fintech’s own CEO and Founder, Christian Frahm, was invited to open the show on the topic of “trust in innovation” – a topic dear to all of our hearts in United Fintech.

The speech was obviously designed to highlight United Fintech’s innovative approach to collaboration between banks and fintechs, but it was also designed to address some common challenges the industry is facing at the moment, particularly how difficult it is to adapt to the digital era and compete in the neobank/neobroker space. These new players are much more agile, come with lower costs, and an entirely different business model that doesn’t require as much regulatory compliance as the banking space.

Financial institutions are a core part of society but if they only stick to legacy systems and aren’t willing to embrace change, their future is shaky. By internalizing digital transformation and choosing the right, adaptive partners in their move from analog to digital, they might have a fighting chance.

Banks need help. We’re here to help them.

Struggling with finding a competent fintech partner? Here’s a guide with the most useful questions to help you find the best match

Market data trendspotting at SIPUGday

SIPUGday – like many other events in the finance and technology space – is a great place to spot new industry trends. This year was no different.

The main trend our team spotted was sustainability and ESG (Environmental, Social & Governance Data): In the world of data providers, ESG is at the front and center of everyone’s agenda – and rightly so.

Another major trend, and perhaps this isn’t a trend as much as an overall theme, is the quest for lower costs and better access to data. The world of financial data grows exponentially, yet the trouble around costs and access persists. With more players in the field, why is data still so expensive? Ultimately, it’s up to the community to decide how the next decade plays out with regard to the dissemination of data and the trust the end-clients have in the industry providers. We think it’s long overdue that these things are discussed, hopefully leading to actual change in the near future with better access to cheaper market data for all.

About SIPUG

The SIPUG has emerged from a multi-year collaboration of an informal group of experts from Swiss large banks. Founded in 1992 and registered as an association in the commercial register, the SIPUG ensures the representation of common members’ interests against information and system suppliers, especially in the areas of exchange information and transaction systems, as well as the suppliers of infrastructure systems for trading facilities.