When was the last time you heard someone talk about how much they really loved their bank?

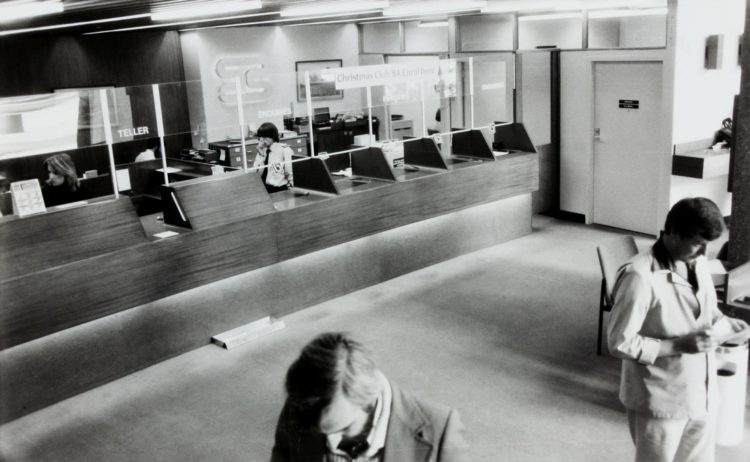

As financial services transform into an industry dominated by sky-high customer expectations, many banks have noticed a satisfaction gap. Customers, used to seamless mobile technology and endless personalization, are no longer satisfied with the brick-and-mortar banking of the 20th century.

Traditional banks are struggling to keep pace with other industries, held back by legacy technology, burdensome regulations, and diverse customer needs. The cost of digital innovation is too high, and creating their own fintech offshoots risks too much cannibalization of their core customer base.

Enter neobanks. These fintech upstarts bridge the gap between banks and customers by offering innovative and user-friendly services which sit on top of traditional bank offerings.

The rapid rise of neobanks around the world

Neobanks are fully digital banks — they exist entirely online without any physical presence in a customer-facing location. Also called challenger banks, they provide a variety of financial services from money transfers, lending, payments and more — all in a digital, and often mobile-first, environment.

Compared to traditional banks, neobanks typically offer fewer, or more specialized services. Their slimmed-down product portfolio combined with their online-only model allows them to operate more efficiently, passing on savings to their customers in the form of lower fees and higher interest rates.

In a classic sense, however, most neobanks are not technically banks at all. They do not have their own banking license or charter, instead relying on partners to provide licensed services.

Still, these relative newcomers clearly fill a market need, as evidenced by their massive growth. At the end of 2020, there were 256 neobanks worldwide, up from 60 in 2018, while in Europe, over 50 million people have opened an account at a neobank.

Want access to the best fintech products on a central platform? Our platform reduces costs, drives automation, and delivers efficiency within Capital Markets. Learn more

In the US, neobanks are quickly taking over as the primary account for many consumers, especially among Gen Z and Millennials. Within one year, the number of these customers with a primary account at a neobank grew from 4% to 15%. Chime, one of the largest neobanks in the US, saw their customer base grow from 8 million in 2020 to over 12 million in 2021.

That means, of course, that traditional “megabanks” are losing out. The top three banks in the US — Bank of America, Wells Fargo, and JPMorgan Chase — saw their share of primary bank customers drop by almost 7% in 2020.

The risks and rewards of neobanking

Neobanks solve some of the most common banking frustrations. They make it easier than ever to open an account from home, prioritizing user experience and 24/7 availability. With lower fees and higher interest rates, they offer customers an enticing package for basic banking services like savings and checking accounts.

In the US, neobanks serve an often overlooked population — those who do not have a bank account at all. According to the Federal Deposit Insurance Corporation, “over 6% of U.S. households, or a total 14.1 million American adults, are unbanked.” By making banking more accessible, neobanks are seeing huge growth within this cohort.

Some neobanks focus on value-adding services like account aggregation to help with analyzing expenses or setting a budget, while others offer support for improving financial literacy and helping customers develop smart savings strategies.

On the hunt for new technology? Here are 50 questions to help you choose the right fintech partner. Learn more

Still, neobanks are not yet in a position to replace traditional banks for most customers. Mortgages and large lines of credit are still largely outside the scope of most neobanks — although with strategic partnerships this distinction may be hard to notice for the end customer — and most of them can’t compete with the rewards-rich credit cards from the top banks.

On the other hand, one person’s convenience is another person’s frustration. The lack of physical branches may not trouble some users, but it is certainly a limitation for others. Neobanks try to compensate for this lack of physical presence with extended online customer service, but that requires a deftness with technology that not all banking customers possess.

The biggest risk consumers face is security in case the company fails or goes bust. This is why it’s so important for customers to check if their neobank is recognized by a governing body or backed by a partner bank.

How do neobanks make money?

Within the retail sector, most traditional banks earn a large portion of their income through offering loans and mortgages. Neobanks have a slightly different business model.

One key difference is the interchange rate, that is, the fees merchants must pay when customers use their debit cards with them. Since neobanks are smaller, they are allowed to charge interchange fees up to seven times higher than other banks. They also typically charge higher fees at ATMs.

As neobanks typically offer limited or no credit, their risk is much lower than traditional banks, which keeps their costs down. Combined with their lack of expenditure on physical locations, they’re able to operate more efficiently than traditional banks, passing those savings on to customers.

Still, at the end of the day, neobanks are technology companies, and that means they’re also backed by VC money. In 2020, as part of a Series F funding round, Chime raised $485 million, while in 2021, Varo added $63 million to its previous funding of over $400 million.

Earlier this year, FamPay, which offers an introduction to banking for teens in India, raised $38 million in Series A funding. One of their key revenue streams is an in-app commerce tool that will display messages from advertisers looking to target that age group.

But despite sky-high valuations and creative business models, the road to profitability is not always clear.

According to a report from Exton Consulting: “On their quest for monetizing customer relationships Neobanks have learned a first lesson: payment transaction fees, premium account subscription fees, or open banking commissions from brokering 3rd party services will in most cases not be sufficient to generate profits or breach beyond operational break-even.”

Focusing on their niche

One way neobanks can succeed — and eke out an advantage over traditional banks — is to develop highly specialized offerings for their core target market.

Chime, the biggest neobank in the US, focuses on products that attract low- to middle-income consumers. They offer features like early access to direct-deposit paychecks, the ability to overdraw a debit account without penalty, and a special credit card designed to help customers improve their credit.

But income level isn’t where the individualization ends. Neobanks around the world are popping up to cater to people from different religious or ethnic backgrounds, international and multilingual communities, as well as various professional specializations.

Looking for a partner in digital transformation? United Fintech is here to empower financial institutions to thrive and compete in the digital era.

The examples are almost endless. Revolut and TransferWise specialize in international transfers and expat customers. First Boulevard caters to black consumers in the US, promising to help build “generational wealth.” Daylight focuses on an LGBT customer-group, offering “rewards for spending in line with your values.” Bank Dora is fully bilingual in English and Spanish. Fardows serves an Islamic population, allowing customers to “save, spend and invest in a halal and efficient way.” Panacea Financial offers special loans and insurance to physicians and dentists.

“In some respects, challenger banks have become the new ‘community’ bank,” said Ron Shevlin, Managing Director of Fintech Research at Cornerstone Advisers. “It’s just that the communities they serve aren’t geographic communities, but affinity-based communities.”

21st century showdown: banks vs neobanks

When predicting future banking trends, it’s helpful to remember that bank accounts are not a zero sum game. It’s very feasible for one customer to hold multiple financial accounts, and that likelihood is set to grow.

At the same time, many consumers are still not deeply invested — if you’ll forgive the pun — in where they keep their money. Neutrality seems to be the primary feeling, as consumers report that their primary bank has “no impact on their financial health and performance.”

Switching costs still remain high, and with so many neobanks allowing customers to link bank accounts, it’s easy to imagine a future of traditional banks and neobanks coexisting to the other’s mutual benefit.

But while customers may stick with their traditional bank out of habit, it’s easy to see how customers will grow to become fiercely loyal to companies that offer them specialized services and align with their values.

This, more than anything else, should be a wake up call for all banks. Focusing on improving their technology isn’t enough. Customers want greater transparency and personalization – and traditional banks are in a prime position to offer that.

Traditional banks can leverage their stability to create a platform for new offshoots — using the parent bank’s license as a starting point. By building or partnering with the right fintech providers, they can bypass their own legacy systems and start playing in a new sandbox, and offer a “best of both worlds” solution.

About United Fintech

United Fintech offers the best fintech products on one central platform. We enable banks and financial institutions to access innovative digital technologies — including real-time data, trading charts, and financial news — by partnering with engineering-led fintech companies with proven capital markets products.

Learn more at https://unitedfintech.com