In their 2015 working paper on corporate and investment banking, McKinsey laid out two routes to digital success in capital markets.

One, recommended sparingly, was the all-in approach, incorporating digital technologies into every aspect of the business model. The second was the targeted approach, shying away from unproven tools and untested models, focusing only on what is needed to protect current business and improve operational efficiency.

Now, six years later, the recommendations have changed.

Today, over 90% of technology executives at capital markets firms say their company has a long-term plan for technology innovation throughout the business, with digital transformation supporting 36% of overall revenue in 2020.

But the road to digital nirvana isn’t smooth. Aside from the recurrent challenges of heightened regulations, security demands, and lengthy compliance and onboarding procedures, capital markets firms must also battle a lack of support from both executive leadership and employees.

So how can players in the capital market industry reap the benefits of new technology in an industry saddled with legacy systems and extreme risk-aversion?

Digital growth: build, buy, or partner

Firms that have followed McKinsey’s targeted approach have still, no doubt, introduced many new technologies into their ecosystems since 2015, from cloud computing to real-time data to machine learning and automation. These have largely been incorporated as add-ons, sitting on top of legacy systems, and often disconnected from horizontal services.

True digital transformation requires a more strategic approach to digitalization, introducing a more agile foundation upon which to build or connect new, more robust, digital business models.

But first, all modern companies looking to digitize have to first answer the age-old question: build, buy, or partner? In the financial sector, this question comes with extra considerations.

With fintech startups rapidly outpacing banks and other financial institutions, the option to build solutions in-house carries significant upfront investment, and still risks losing out to leaner groups. At the same time, buying technology through acquisitions is costly, lengthy, and full of risk.

That leaves partnering, but for capital markets firms, the increased complexity of the regulatory environment and legacy frameworks makes the process of onboarding new, external digital tools laborious and time-consuming.

Now, take this dilemma and scale it up for all the digital capabilities your firm needs to succeed. Partnering individually with many single-solution fintechs seems insurmountably complicated, and, if built on an outdated IT infrastructure, may result in difficult-to-maintain technology silos.

For capital markets firms, moving from McKinsey’s targeted approach to the all-in model is no small decision.

Should banks view fintechs as a cause for rivalry or collaboration? Read why we think both can thrive in the world of finance if they join forces.

The case for human transformation

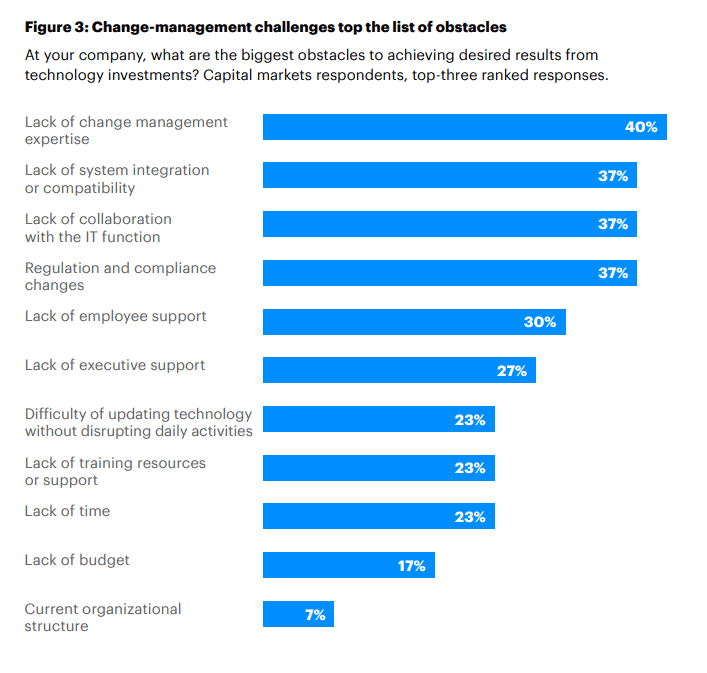

When asked about the greatest barriers to achieving results from technology, leaders at capital markets firms ranked cultural barriers similarly as high as technical concerns.

Lack of change management expertise topped the list (40%) followed by lack of system integration and compatibility (37%), regulation and compliance changes (37%), and lack of support from employees (30%) and executives (27%).

Perhaps workers in this industry are burned out after being inundated with new technologies that don’t deliver or, worse, never make it to market due to compliance or security concerns. Or perhaps they look at the tech stack they currently use and are overwhelmed by the number of tools they’re already struggling to maintain.

Certainly, when it comes to updating the entrenched legacy systems in place at many capital markets firms, the challenge is formidable. The cost of overhauling an entire IT infrastructure is compounded by switching costs, the risks of downtime, and the time and effort needed to train and support your workforce.

Still, the cost of doing nothing may be greater, as firms pay increasingly high costs to maintain fragile IT systems while still lagging behind more tech-savvy competitors.

The investment of digital transformation may be great, but those who succeed will have the chance “to convert technical debt into technical equity.”

Digital success starts with culture

Assessing risk is a fundamental part of working in capital markets. So it’s natural that many firms have adopted a “wait and see” approach to digital transformation.

However, the risk is now that firms who are unable to keep pace with digital first-movers will be left behind, as other companies outperform them in product offerings, customer service, and cost-efficiency.

Perhaps the greatest challenge to overcome is not technical at all, but human.

Resistance to digital transformation is largely driven by fears of workforce shrinkage (90% of capital markets leaders think that virtual assistants will handle more than half of all customer interactions within the next five years) and a lack of support in building the necessary digital skills among existing employees.

Capital markets firms looking to succeed with their digital transformation will have to address both challenges: human and technological.

Both challenges can be met by establishing an ecosystem of strategic digital partnerships to scale digital innovation and secure employee buy-in with user-friendly, human-centric technology.

If McKinsey were to update their report in 2021, they might combine their all-in and targeted approaches, cementing the philosophy that every company is a tech company, but no company exists in isolation.

It’s time for capital markets firms to go all-in.

About United Fintech

United Fintech offers the best fintech products on one central platform. We enable banks and financial institutions to access innovative digital technologies by partnering with engineering-led fintech companies with proven capital markets products.

We deliver real-time market data to market professionals at a fraction of the usual costs as well as the hugely popular information terminal NetStation.

Learn more about United Fintech here.