Companies

Products

Fair Value Pricing

Independent fair value pricing for added transparency where current prices are not readily available

The right data and tools for your trading and investment needs

One connection to global, multi-asset analytics, news and insights

Flexible solutions, comprehensive market data and services

Innovative, efficient, buy-side workflow automation solutions

All the data required for reporting and enhanced compliance

Digital solutions for a premium client experience

Enterprise-wide digitalization through a single platform

One platform, end-to-end digital transformation

Keep pace with technology, exceed customer expectations

Monitor, measure and maximize value

Quality, multi-asset data and analytics from a single vendor

'One stop' smart access to global trading and market data

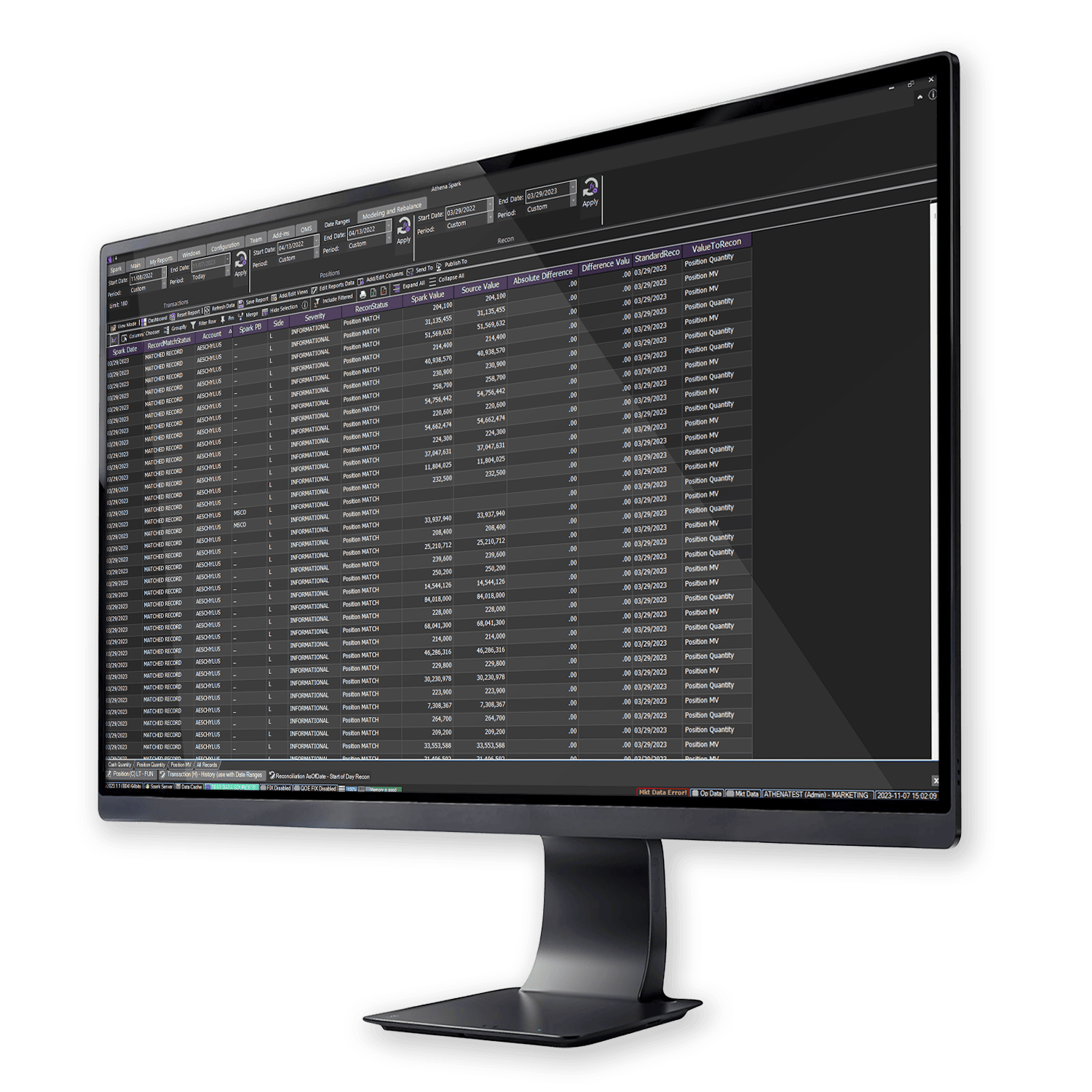

Order & Portfolio Management System

Athena is the front-to-back platform that supports you in digitizing and automating processes adding operational agility to comply with markets' regulations, operate effectively, and maximize your investors' ROI.

Your operations under one single license

Avoid the need to integrate different systems through APIs to manage your entire investment process. With Athena, you can do it from a single centralized platform.

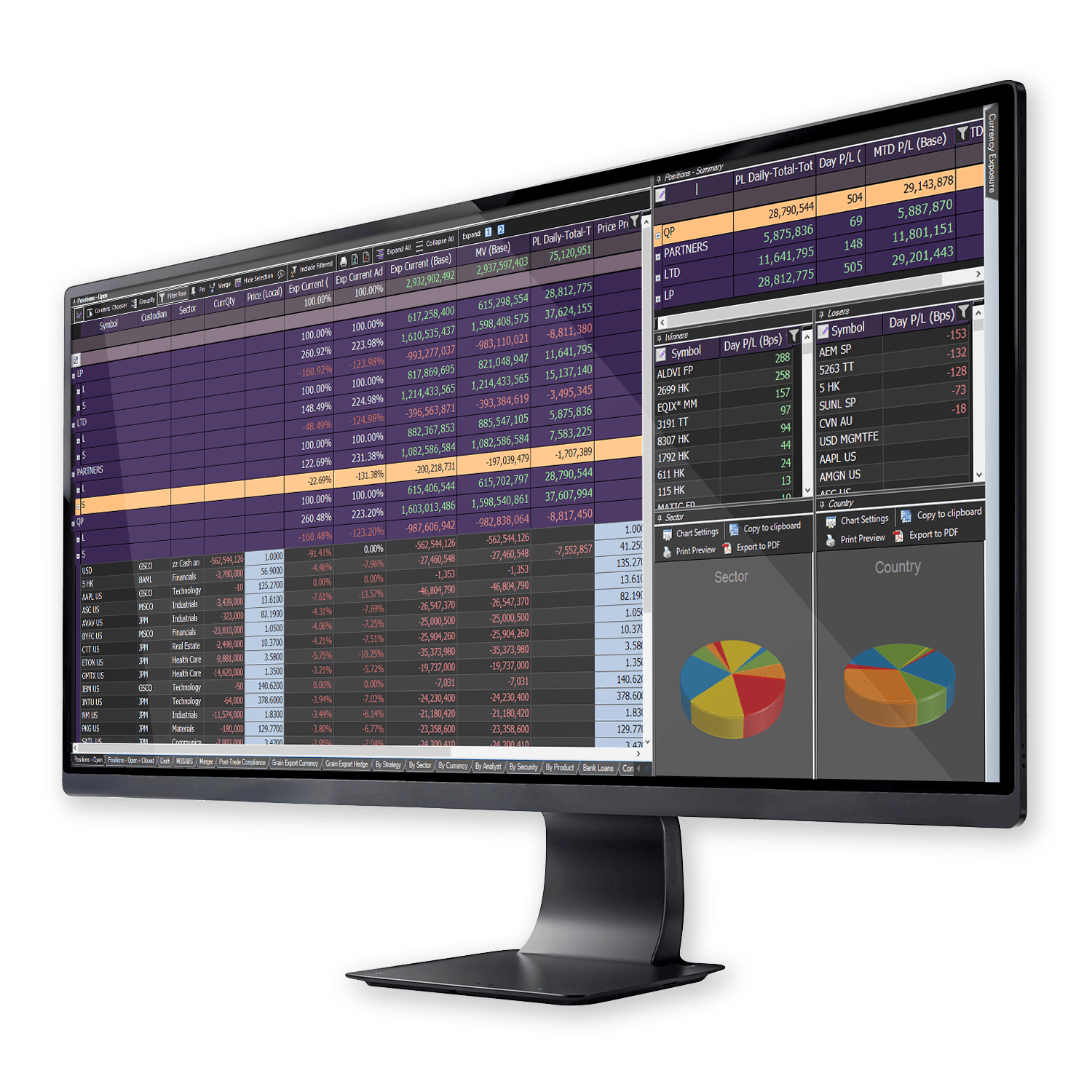

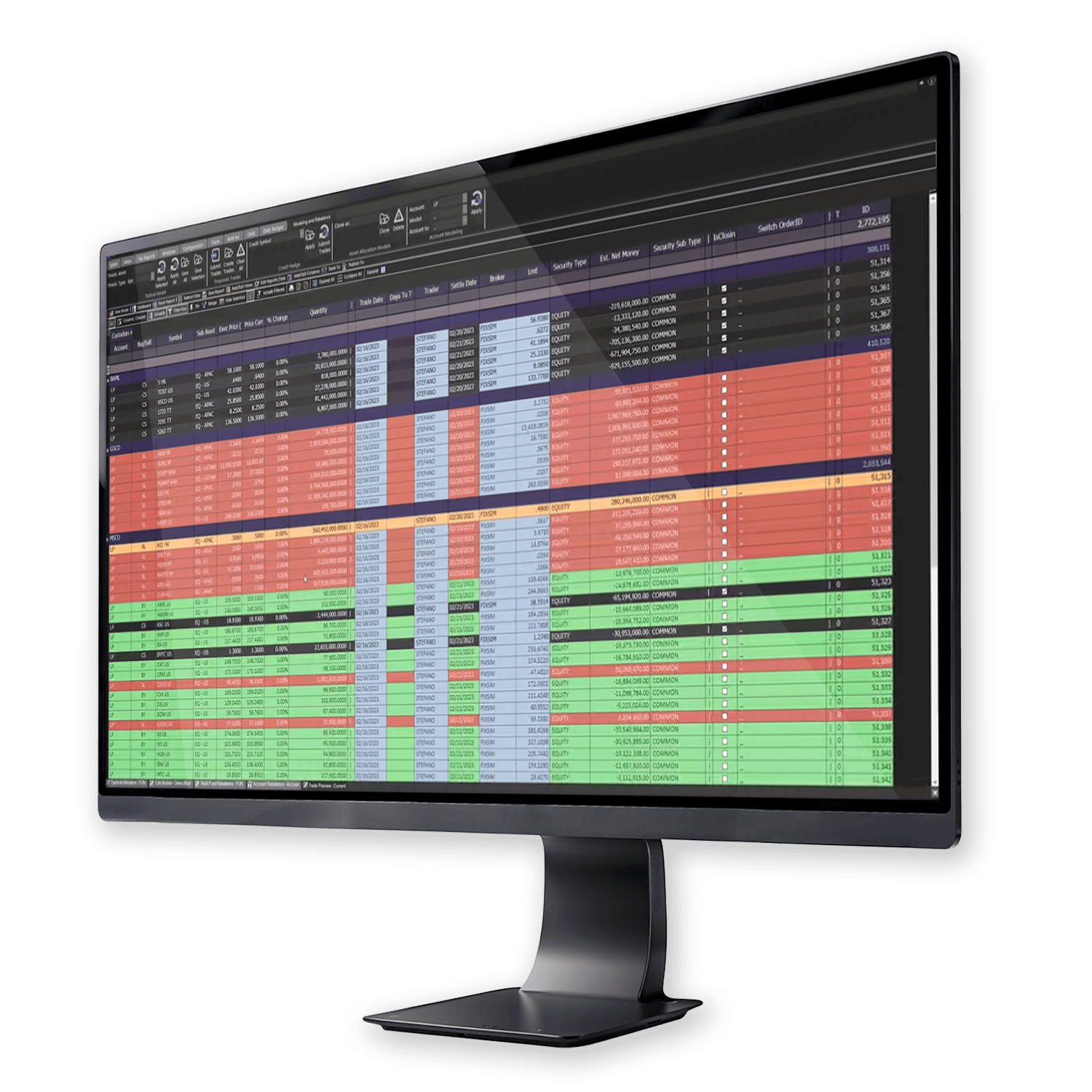

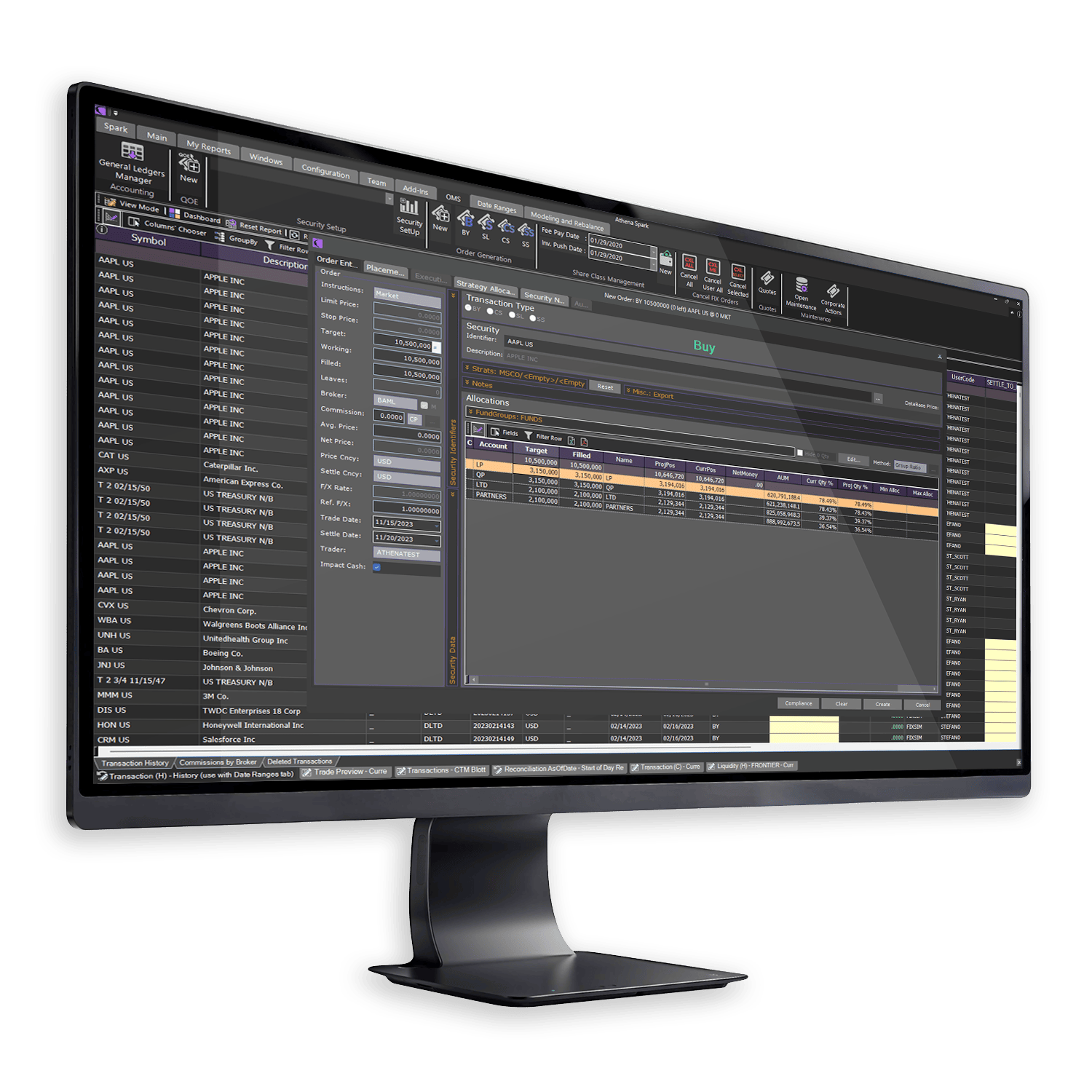

Traders and portfolio managers rely on a robust Order, Portfolio, and Risk Management Software that guarantees accuracy, speed, and versatility

Read more below

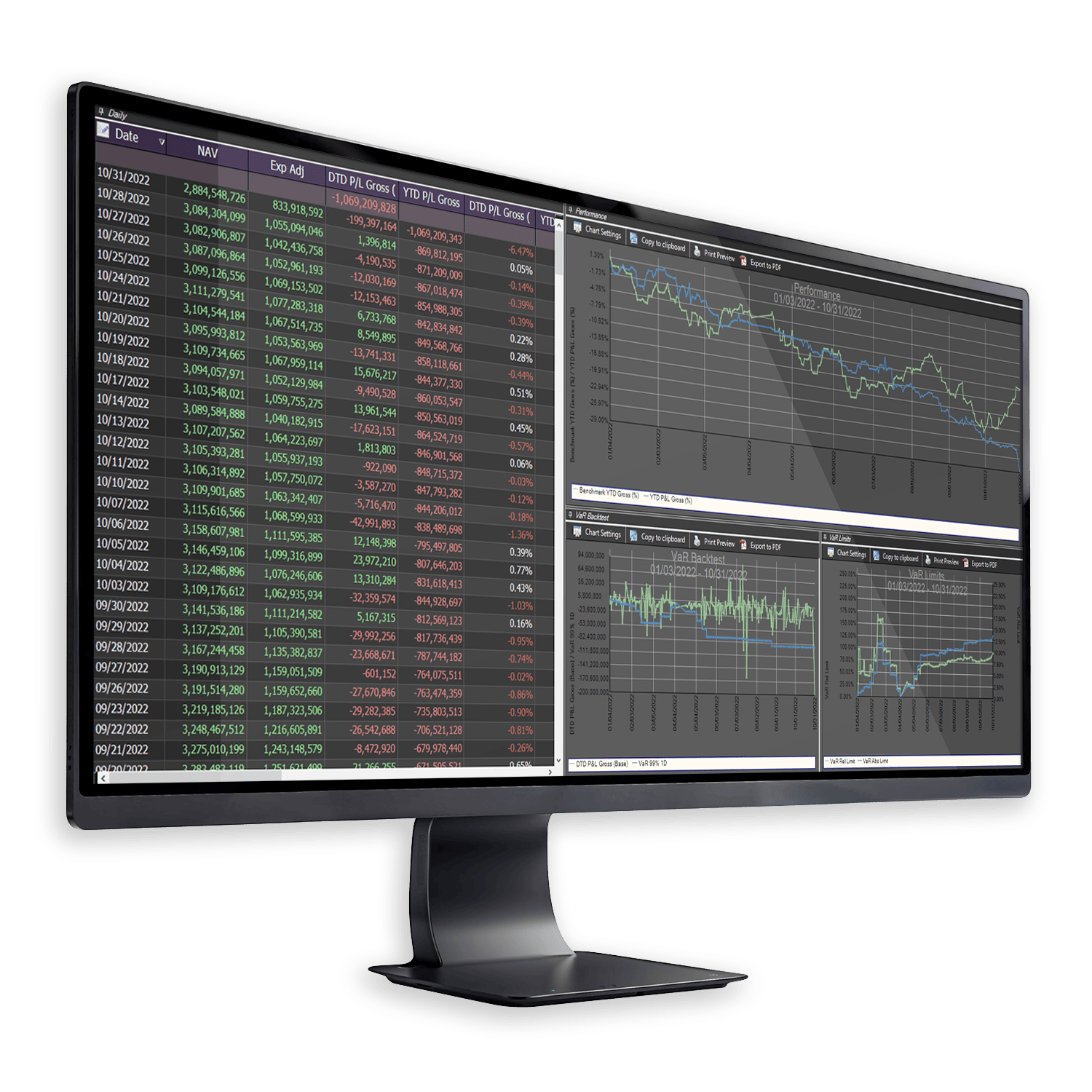

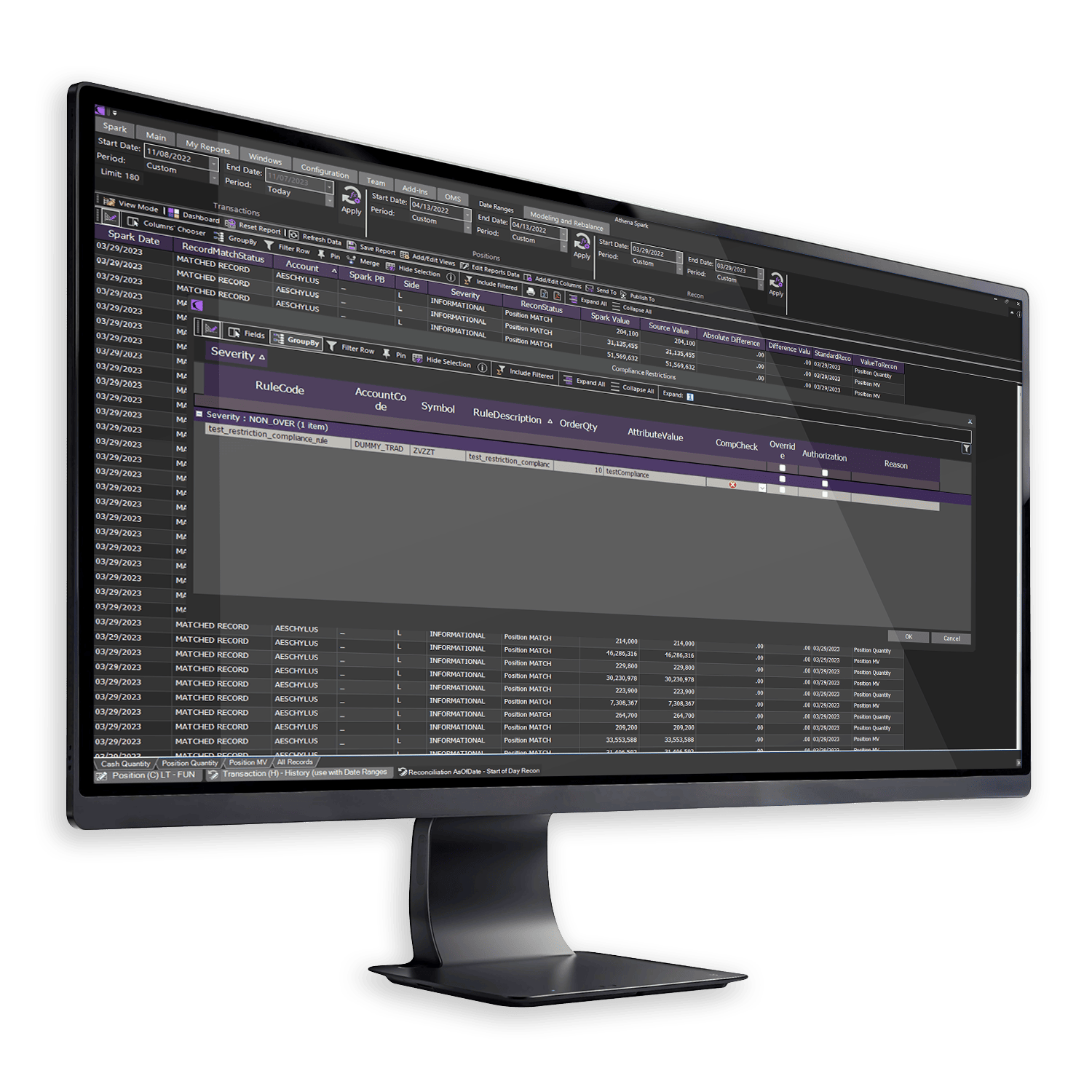

Effectively manage the risk and compliance of your portfolio through a number of risk calculators, reporting, and alerts

Read more below

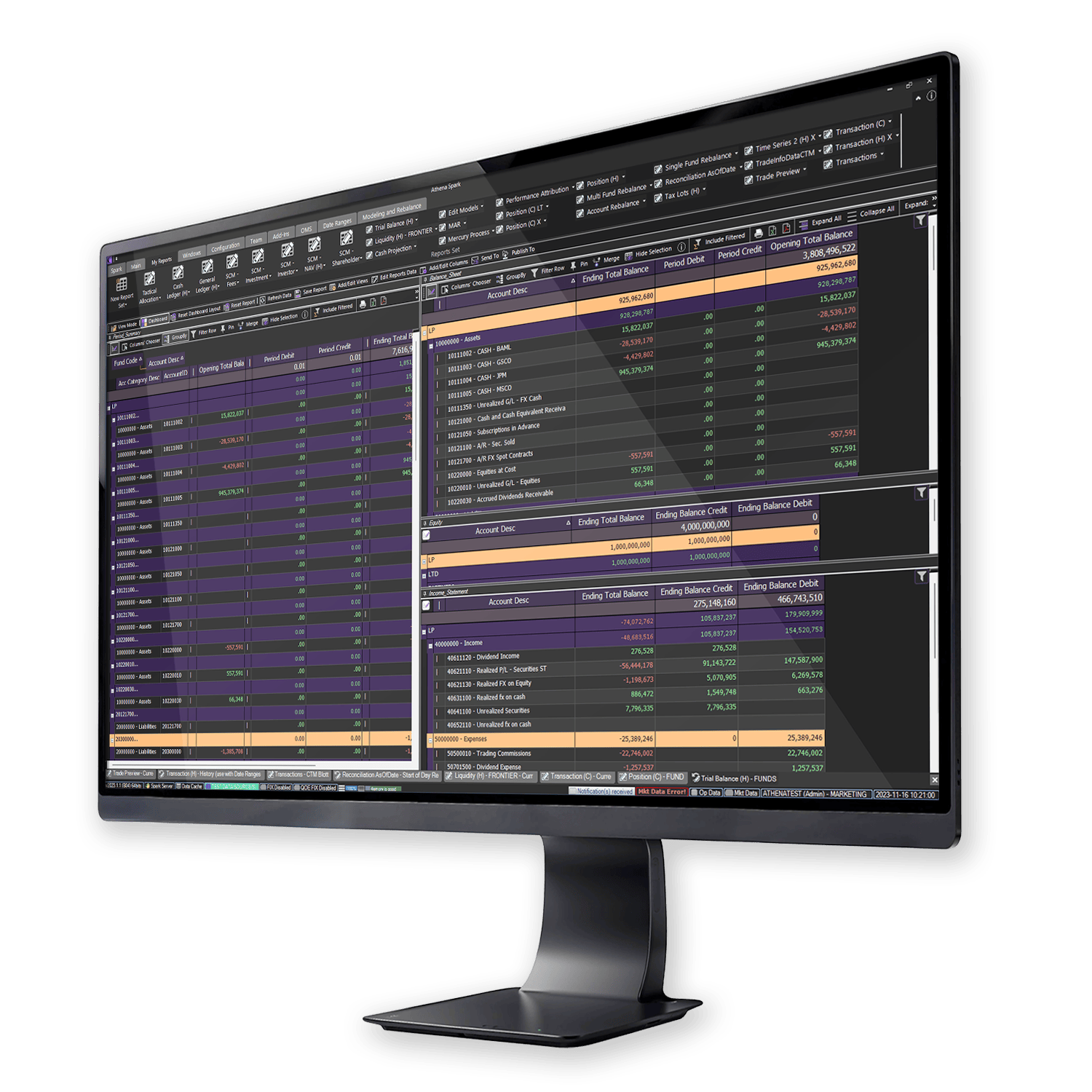

Accountants and trade managers benefit from modules such as the Reconciliation, Fund Accounting, Investor Accounting, Straight-Through Processing, SFTP connections, etc.

Read more below

Contact us to explore how Athena meets your business requirements.

Athena was founded in response to a common problem in the Financial Industry: the inflexibility of many OMS/PMS solutions. Our mission is to empower our clients, offering a flexible and responsive system tailored to your specific needs.

Luis Otero, CTO of Athena & United Fintech

Our clients are the central focus at Athena. We cherish providing white-glove experiences and develop solutions that extend beyond mere tech support, integrating Athena as a core addition to your firm.

Stefano Guarnieri, Managing Director & Head of Product at Athena

Athena has experienced tremendous growth over the past couple of years, and our strategic talks with new investors have confirmed our strong conviction in its suite of products and expansion of the buy-side pillar of United Fintech.

Marc Levin, CEO of Athena

Shape the digital future for financial institutions

together with United Fintech and our partner companies.