Companies

Products

Fair Value Pricing

Independent fair value pricing for added transparency where current prices are not readily available

The right data and tools for your trading and investment needs

One connection to global, multi-asset analytics, news and insights

Flexible solutions, comprehensive market data and services

Innovative, efficient, buy-side workflow automation solutions

All the data required for reporting and enhanced compliance

Digital solutions for a premium client experience

Enterprise-wide digitalization through a single platform

One platform, end-to-end digital transformation

Keep pace with technology, exceed customer expectations

Monitor, measure and maximize value

Quality, multi-asset data and analytics from a single vendor

'One stop' smart access to global trading and market data

Delivered by TTMzero

Gain insights into how the Financial Instruments Automation Platform (FIAP) can help your firm enhance productivity, reduce errors, and optimise workflows. Dive further into the product offering to understand how it supports your firm.

TABLE OF CONTENTS

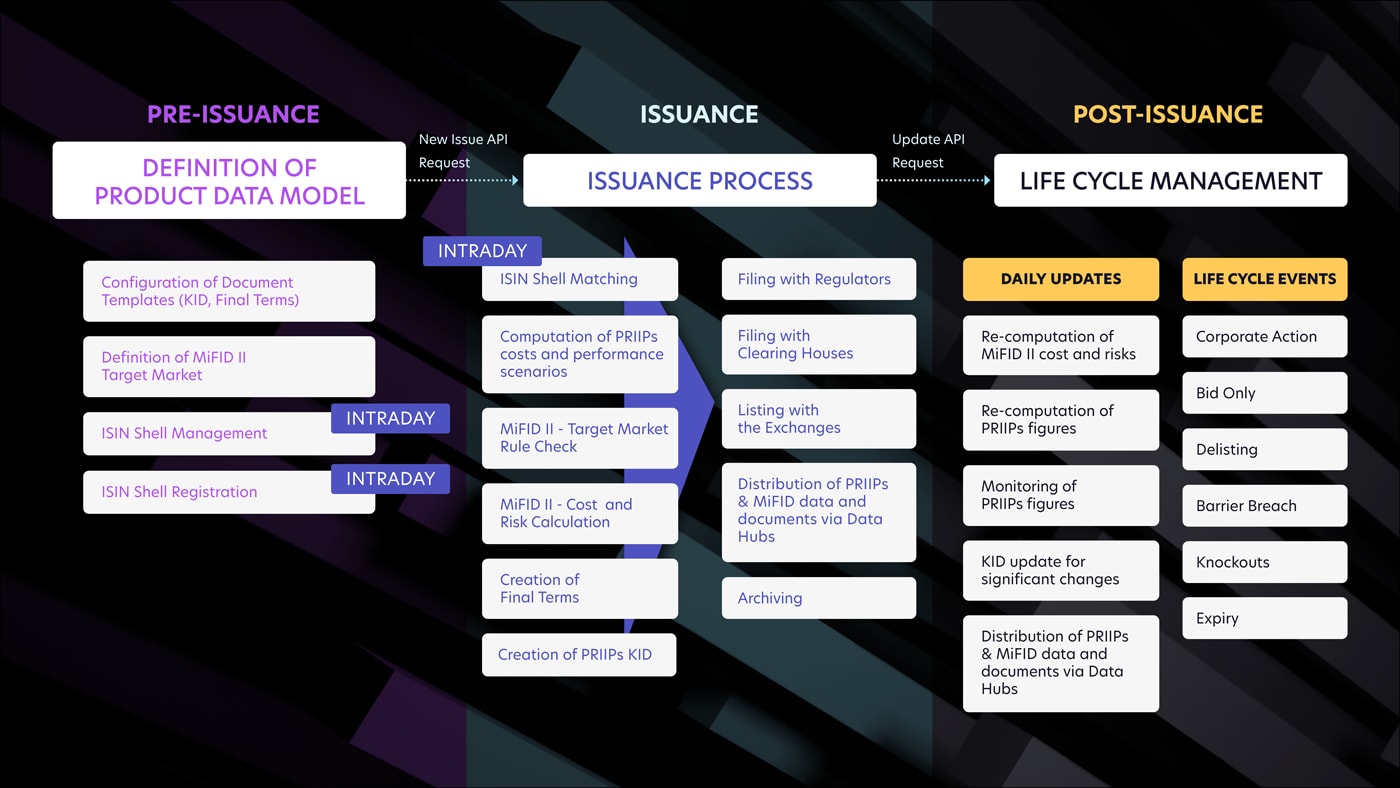

Efficient and seamless issuance management

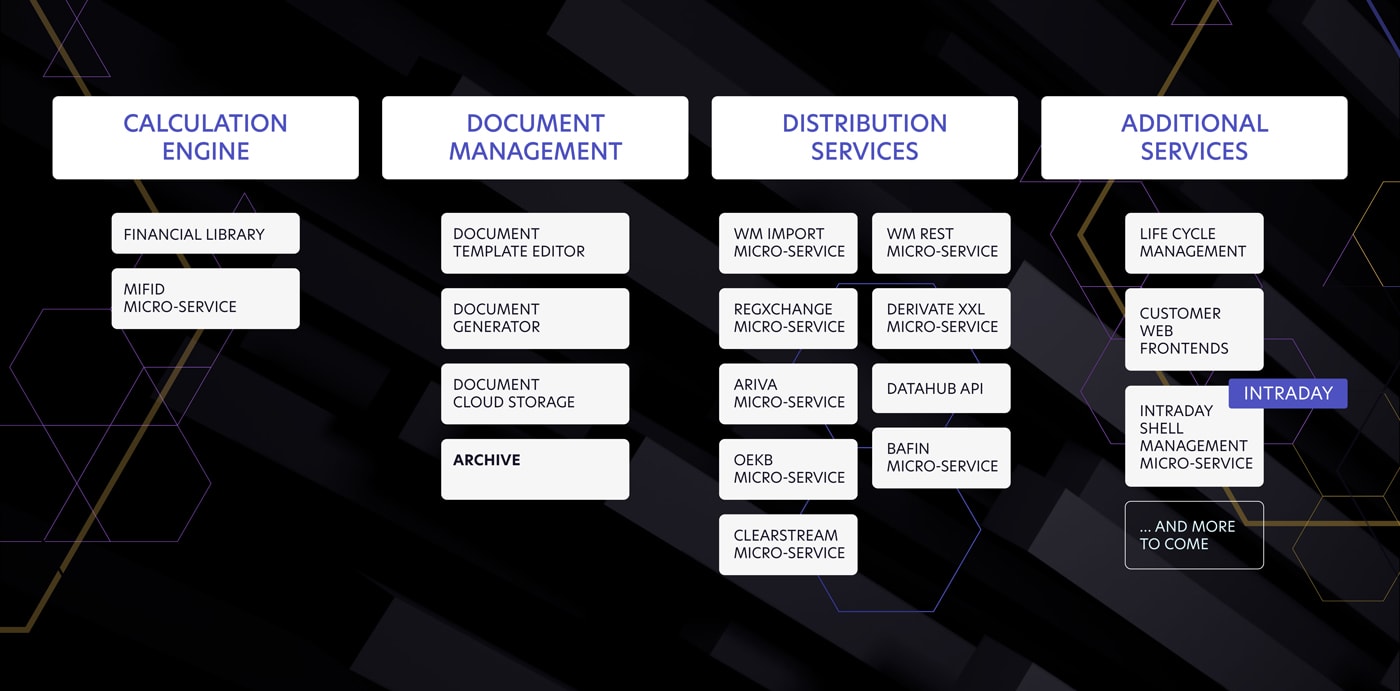

Our services encompass the pre-issuance phase, involving tasks such as defining the data model for various product types, configuring document templates, and specifying MiFID target market classifications. During the actual issuance process, FIAP seamlessly manages multiple parallel workflows, including the creation of Final Terms, computation of PRIIPs key figures, and performance scenarios, MiFID target market assignment and validation checks, as well as cost and risk calculations. Building on this input, FIAP generates PRIIPs KIDs, systematically storing both data and documents in secured databases and distributing them via an interface network to third parties and data hubs for further processing.Daily monitoring - throughout the entire life-cycle

Following the issuance, TTMzero monitors your product and the PRIIPs key figures on a daily basis: FIAP re-computes MiFID II costs and risks and whenever any significant changes are detected that necessitate a new KID document, the platform automatically creates a new KID and distributes the document as well as the product data to the relevant third parties.Directly connected to multiple third parties

TTMzero has extensive network connections with supervisory authorities, market data providers, stock exchanges, and custodians allowing FIAP to support you in seamlessly filing your product with regulators, listing them with exchanges, and efficiently distributing data and documents to third parties. Experience the efficiency and ease of optimised business processes with Financial Instruments Automation Platform (FIAP).We can build adapters to additional third parties upon request!

The calculation of PRIIPs Key Figures as offered by our FIAP platform includes the following figures:

Under MiFID II, manufacturers must identify the potential target market for every financial instrument and continuously ensure compliance for each financial instrument they offer. Leveraging FIAP supports your in staying compliant.

The FIAP platform supports MiFID II compliance by enabling manufacturers to:

FIAP also facilitates automated monitoring of validation rule violations, alerting customers through the MiFID dashboard and email notifications if violations occur. Manufacturers can use the FIAP dashboard for audit-proof exception handling.

KIDs (Key Information Documents) are produced fully automated via the FIAP platform. This includes the following services:

All KID documents produced by FIAP are at all times compliant with the Regulatory Technical Standards (RTS).

In the dynamic world of structured products, immediate adaptation to market shifts and investor needs is the cornerstone of competitiveness. While conventional issuance methods often defer product launches to the next trading day, TTMzero, in partnership with Europe's premier numbering agency, WM Datenservice, has integrated intraday issuance workflows into FIAP.

The Intraday issuance service follows a two-step approach:

FIAP offers a management solution for the rule-based maintenance of an ISIN shell repository for intraday issuances via a web frontend. ISIN shells are automatically created with the required profiles and quantities based on rules defined by the issuer.

The service always keeps the inventory of ISIN shells ready for issuance in accordance with the issuer rules by deleting expired ISIN shells and re-filling the inventory after ISIN shells are consumed for intraday issues.

For every stage of the product’s life cycle - and also before - we have numerous services, modules and process functionalities you can choose from. You decide, where in the process of the creation and maintenance of the product you want FIAP to take over - we develop your individual workflows.

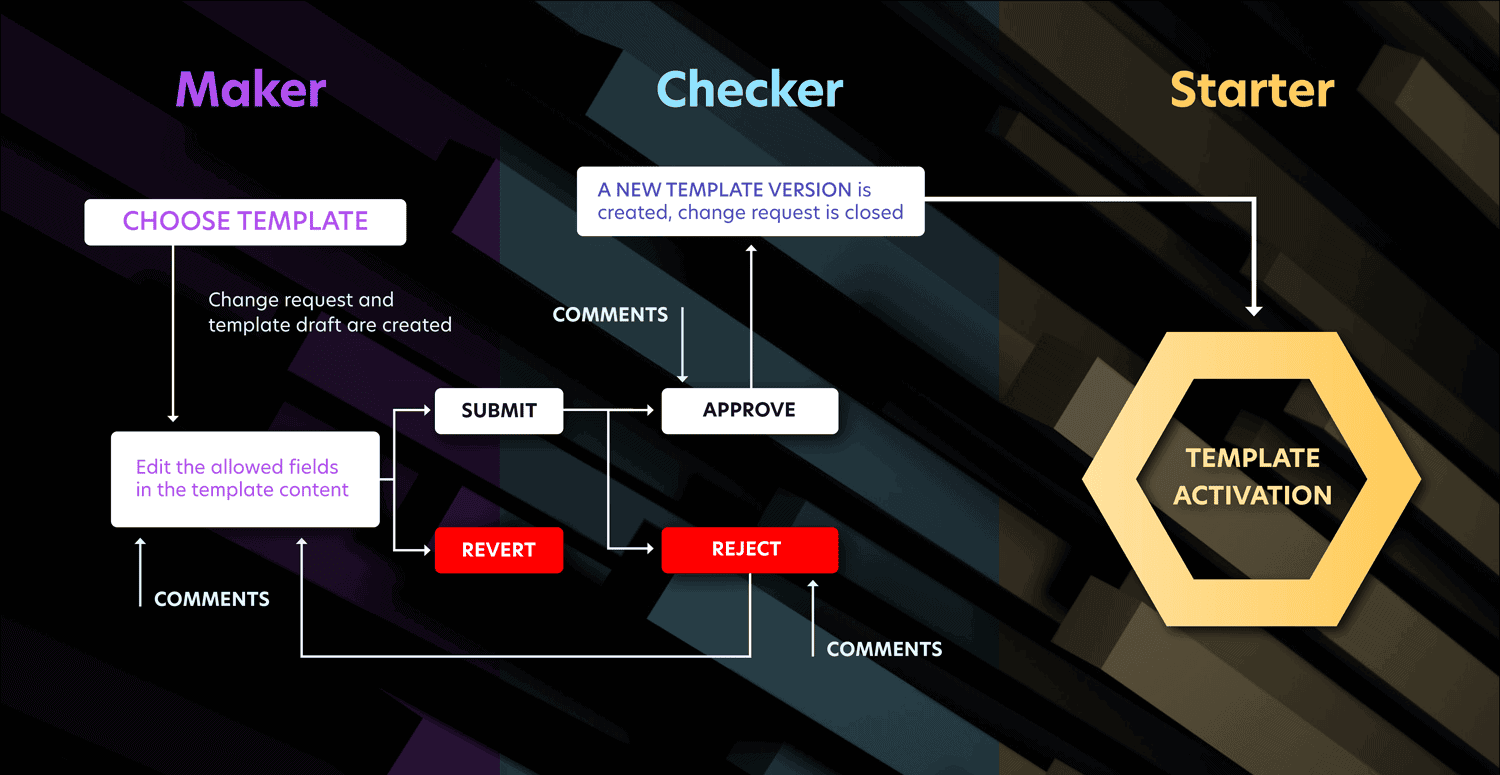

TTMzero’s KID Template Editor is an easy-to-use web frontend that aims to provide user-friendly functionalities to generate and modify document templates for Key Information Documents (KIDs).

It is directly connected to TTMzero’s KID generator service which contains all functionalities for the automated generation of KIDs from approved templates, including the necessary PRIIPs key figure calculations.

TTMzero’s KID Template Editor allows users to independently create new KID templates in multiple languages and to change existing templates without the involvement of TTMzero’s developers.

The web-based application provides default KID templates for all 24 languages that are in scope for the PRIIPs regulation, plus Norwegian.

In the KID Template Editor, clients can personalise templates to reflect their corporate identity, incorporating specific logos, fonts, and colours. The template creation and modification process is governed by a strict four-eyes principle (Maker, Checker, and Starter roles), ensuring a reliable audit trail and collaborative features.

Additionally, the Template Editor keeps detailed logs of all template modifications, providing a thorough history of each template's versions for auditing purposes. The Template Editor allows editing of one document template or multi-document editing of different templates in one editing step. The ability to preview and download documents as PDF files adds to the convenience.

Easy and user-friendly editing and control processes

Four-eyes-principle guaranteed

All changes are logged and thus audit-proof

Multi-template editing supported

Automated notification functions

All change requests are archived and can be accessed at any time

Reduced complexity for producing KIDs in several languages

25 languages supported

Less legal counseling required due to provision of KID template skeletons based on the European Commission’s wording

New payoff types can easily be integrated into the web interface

User roles can be assigned individually for each KID template

Each manufacturer has individual templates specific for their products and corporate design

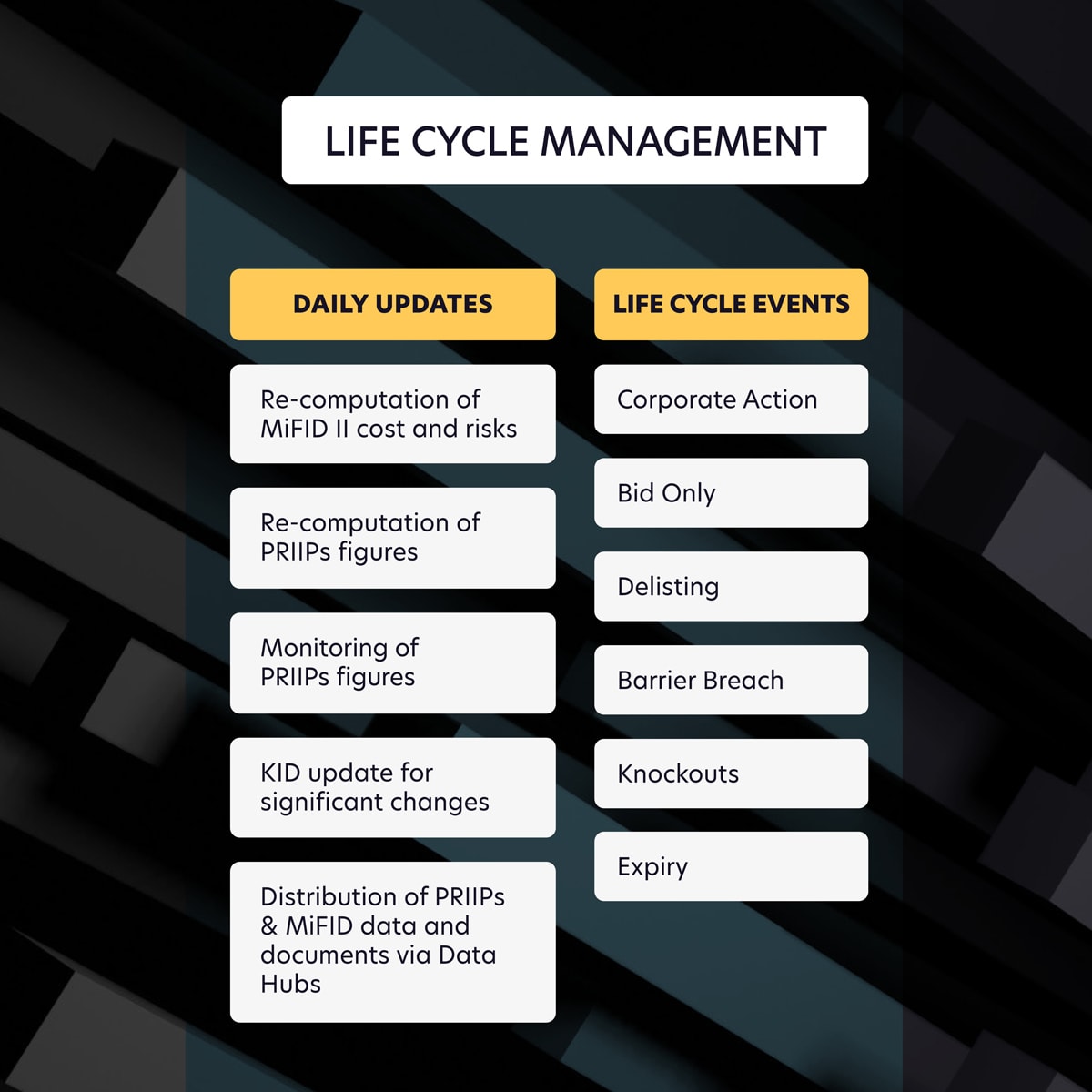

After a product is issued, it needs diligent maintenance for the issuer to be compliant with regulations during the lifetime of the product.

FIAP monitors and recalculates PRIIPs key figures as well as MiFID II cost and risk figures on a daily basis. If “significant changes” are observed, this triggeres a new KID document. Upon this action, the updated data and documents are automatically distributed to the relevant third parties via the connected data hubs. This guarantees that issuers always publish the current KIDs document and ensures you stay compliant with regulations.

Also, some instruments are subject to certain life-cycle events, such as corporate actions or knock-outs that require an update of all related data and documents, which then have to be distributed to all necessary parties.

FIAP users can upload life-cycle events and thereby trigger the process for the subsequent automated handling, which can - among other steps - include the following:

As a comprehensive platform for managing data processes and automating issuance workflows, FIAP generates a significant amount of data and documents while seamlessly executing diverse workflows. This includes simultaneous distribution to various data vendors, enhancing efficiency and streamlining the overall process.

Onboarding on TTMzero’s business-ready platform resulted in a very short time to market. TTMzero’s broad network of third-party connections to regulators, custodians, and data vendors provided all the essential components for building a fully automated production chain from scratch.

Dennis Puschmann, Product Manager at Tradegate

TTMzero’s platform transforms the manufacturing of structured products, centralising issuance, regulatory compliance, and third party interfaces into a seamless one-stop solution.

Jan Hegermann, FIAP Product Owner

Manufacturers of structured products don’t need to operate their own infrastructure - we manage the entire issuance process of their product and beyond.

Simon Ullrich, Founder & Managing Partner at TTMzero

Shape the digital future for financial institutions

together with United Fintech and our partner companies.