Companies

Products

Fair Value Pricing

Independent fair value pricing for added transparency where current prices are not readily available

The right data and tools for your trading and investment needs

One connection to global, multi-asset analytics, news and insights

Flexible solutions, comprehensive market data and services

Innovative, efficient, buy-side workflow automation solutions

All the data required for reporting and enhanced compliance

Digital solutions for a premium client experience

Enterprise-wide digitalization through a single platform

One platform, end-to-end digital transformation

Keep pace with technology, exceed customer expectations

Monitor, measure and maximize value

Quality, multi-asset data and analytics from a single vendor

'One stop' smart access to global trading and market data

Since they emerged in the 80s and 90s, structured products have provided an effective source of funding for investment banks and companies as well as attractive tailored investments for asset managers, financial advisers, and retail investors.

With new regulatory requirements under Packaged Retail Investment and Insurance Products (PRIIPs) soon coming into force, and in a post-pandemic world where economies are struggling with rising costs and dropping standards of living, what value do structured products offer to both those writing them and those investing in them?

Read on for a breakdown of all things structured products, or use these links to jump to the info you need.

1980-2000

Popular across Europe and Asia Pacific, but less so in the USA, where consumer protections inhibit retail investors from trading riskier products, structured products emerged in Europe in the 1980s when they were sold in the UK and France. Over the course of the 90s, they gained popularity in Asia.

2000s

Structured products were a popular alternative investment class throughout the 2000s, before the collapse of Lehman Brothers in 2008. In the aftermath of the financial crisis, structured products fell in popularity.

2010s

New regulations were introduced in the decade following the 2008 financial crisis, and in 2013 the Markets in Financial Instruments Directive (MiFID) and Packaged Retail Investment Products (PRIPs) regulations were introduced, and in 2018 MiFID II came into force and the Packaged Retail Investment and Insurance Products (PRIIPs) and Key Information Document (KID) regulations were introduced.

2020s

The major shocks of the pandemic and Russia’s war against Ukraine have accelerated digitization and led to highly volatile markets, meaning investments offering a degree of predictability can play an important role.

What are structured products?

Structured products combine different financial instruments to create fixed-term hybrid investments offering bespoke risk, return, and payout profiles that are distinct from those available from standard equity or fixed income securities. Returns are based on the performance of the underlying assets of the instruments making up the product.

They can play a useful part in a diversified investment portfolio, and help asset managers target specific investment objectives. They are primarily of interest to retail investors, as they enable them to gain tailored risk exposure to asset classes such as derivatives.

How do structured products work?

With structured products, investors are effectively buying a ‘bundle’ of securities. Instead of identifying complementary investments and buying them separately, investors can simply select prepackaged products that give them the exact risk-return and protection levels they’re looking for.

Most structured products have similar characteristics:

Investors usually have to commit their money for a fixed term. They only get to capitalize on any potential upsides at the expiry date.

These products are assembled to satisfy a wide range of risk profiles, depending on investors’ needs.

Investors can usually guarantee the return of all or some of the nominal value of their initial investment, but there are also products for investors who are happy to risk all their capital.

Typically, structured products combine an asset class offering a predictable yield with more speculative instruments. A classic example is a low-risk bond combined with a stock call option, allowing investors to secure either the principal protection or coupon payments of a bond and also the potential for higher returns if the underlying asset increases in value by the end of the fixed term.

For issuers

These products allow issuers to:

Investment banks wanting to raise capital and issue debt for themselves or other companies traditionally issue bonds or convertible bonds. With structured products, they can issue debt at submarket interest rates by offering investors something in return (an option) for a bond that offers a lower coupon – and charge a premium for the product.

Investment banks that design and issue structured products apply a markup to the prices of the component securities, making them profitable. The products command a higher price because the payoff profiles can be highly attractive and meet investors’ objectives exactly, and also because retail investors will struggle to access the asset classes otherwise.

For investors

These tailored products can add value for different kinds of investors, but especially retail investors. They offer:

If you’re a trading professional, you’ll certainly be able to combine assets on your own to achieve the desired balance of risk and returns, although you may choose these prepackaged products for scalability. But for retail investors, structured products offer a simple way to do the same without much effort or prior market knowledge – plus they usually offer the only way to gain exposure to certain asset classes.

With many structured products, you’re guaranteed to get your initial capital back, unless you’re investing in the more speculative types of products. This compares favorably to buying stocks directly, as that makes you subject to the whims of the market without any true downside protection. For this reason, structured products can be ideal for anyone looking to capitalize on potential market upsides without risking all their money.

Because they can be assembled in so many ways using any combination of asset types, structured products are extremely flexible. They can be adjusted to fit your specific risk profile, include specific asset classes, or align with your predictions about future market trends.

Pre-packaged products are a way for investors to plug in holes in their investment portfolio or activate their money using the exact risk-return ratio they seek. Those with existing portfolios can hedge against unpredictable market movements. Others can capitalize on their market insights and predictions, for example by securing positive returns in bear markets.

While the idea of capital protection can be appealing to investors, it’s important to remember there are risks involved with structured products, including:

Your capital is tied up until the end date of the contract. This affects the liquidity of your assets and limits your ability to continuously reinvest money based on new information.

Depending on the level of principal protection, investors will be exposed to market risk. This means it’s possible to lose some or all of your invested capital if the market takes an unfavorable turn.

Structured products are typically offered by investment or retail banks. They’re not backed by government bodies and are therefore subject to counterparty risk. What this means is that even if the product itself performs favorably, there’s always a risk that the issuing bank becomes insolvent and defaults, meaning you won’t get your money back.

The main way issuers earn money on prepackaged products is by charging a premium for the service of putting them together. While this isn’t a risk per se, it means investors have a higher cost and may lose money on products that otherwise break even.

Investors are attracted to the certainty and feeling that they have a possible upside with no chance of a downside. However, while they won’t suffer any nominal losses, they will suffer the effects of inflation and the opportunity cost of missed returns and market interest rates.

There’s no widely accepted standard for pricing structured products. As such, investors may have a hard time comparing alternative packages from competing issuers or with different combinations of assets. Issuers may also incorporate their own fees into the price of the product itself, which makes it even trickier for investors to fully understand its implicit cost.

While there are dozens of different variations, they commonly fall into these three broad categories:

These types of products offer rather limited potential for any return on investment. Instead, as the name implies, they are used to protect capital during unfavorable market conditions (e.g. negative interest rates). Investors can secure returns comparable to deposit rates, with a minor upside.

The bond + option example above may well fall into this category of capital-protected products.

With this type of products, investors can choose to forego some principal guarantees to receive a higher return. Yield-enhancement products are more risky, but they allow investors to “bet” against the market. This way, investors can end up making profit while the stock market as a whole stagnates or goes down.

These products push both the risks and profit potential even further. Using leverage products, investors can achieve a rate of positive return that actually exceeds the increase in the value of the underlying asset itself. On the flip side, investors must also accept the possibility of losing the entirety of their invested capital.

In a nutshell, the price of a structured product is the sum of what it costs to buy its individual components plus the premium charged by the issuer. Depending on the issuer, they’ll either charge their premium fee separately or “bake it into” the price structure of the product itself.

For the casual investor, these tailored products may make sense for a number of reasons.

If you’re a trading professional, you’ll certainly be able to combine assets on your own to achieve the desired balance of risk and returns. But for the uninitiated, structured products offer a simple way to do the same without much effort or prior market knowledge.

Additionally, buying pre-packaged products may often grant an investor access to an asset class that they can’t purchase directly.

In general, you’re guaranteed to get your initial capital back, unless you’re investing in the more speculative types of products. This compares favorably to buying stocks directly, as that makes you subject to the whims of the market without any true downside protection.

For this reason, structured products can be ideal for anyone looking to capitalize on potential market upsides without risking all of their money.

Because they can be assembled in so many ways using any combination of asset types, structured products are extremely flexible. They can be adjusted to fit your specific risk profile, include specific asset classes, or align with your predictions about future market trends.

Pre-packaged products are a way for investors to plug in holes in their investment portfolio or activate their money using the exact risk-return ratio they seek. Those with existing portfolios can hedge against unpredictable market movements. Others can capitalize on their market insights and predictions by e.g. securing positive returns in bear markets.

Few investments come without risks, and structured products are no exception. Here are the main risks and downsides people should take into account.

With such products, your capital is tied up until the end date of the contract. This affects the liquidity of your assets and limits your ability to continuously reinvest money based on new information.

Depending on the level of principal protection, investors will be exposed to market risk. This means it’s possible to lose some or all of your invested capital if the market takes an unfavorable turn.

Structured products are typically offered by investment or retail banks. They’re not backed by government bodies and are therefore subject to counterparty risk. What this means is that even if the product itself performs favorably, there’s always a risk that you won’t get your money. (Such as if the bank in question becomes insolvent or goes bankrupt altogether.)

The main way issuers earn money on pre-packaged products is by charging a premium for the service of putting them together. While this isn’t a risk per se, it means investors have a higher cost and may lose money on products that otherwise break even.

There’s no widely accepted standard for pricing structured products. As such, investors may have a hard time comparing alternative packages from competing issuers or with different combinations of assets. Issuers may also incorporate their own fees into the price of the product itself, which makes it even trickier for investors to fully understand its implicit cost.

TTMzero: Automated solutions for capital markets

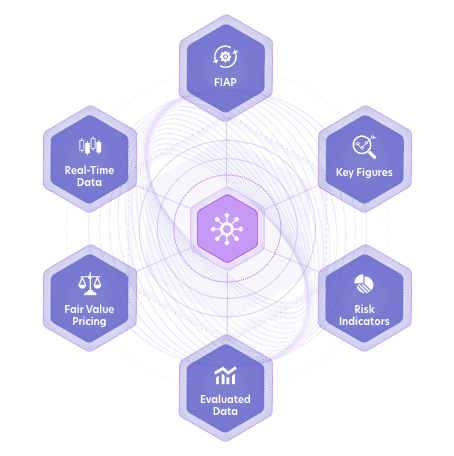

One of United Fintech's portfolio companies, TTMzero, provides high-quality real-time data and fully digitized regulatory and capital markets tech solutions that take clients into a new digital era.

To learn more about TTMzero's solutions, click on the products below:

Products

Key Figures and Risk Indicators

TTMzero calculates about 100 key figures for structured products, including the Greeks and risk indicators, which provide precise risk and return probabilities.

Explore product

Financial Instruments Automation Platform

Digitize your issuance processes with TTMzero’s Financial Instruments Automation Platform (FIAP) to allow for a fast market launch of new products and ensure straight-through workflows. Also includes PRIIPs for KIDs.

Explore product

Shape the digital future for financial institutions

together with United Fintech and our partner companies.