5 benefits of using real-time market data

Markets change fast, and staying up-to-date is a must, especially for investors. To make sure that clients can benefit from what is happening in real-time, online brokerages use real-time market data feeds.

What is real-time market data as opposed to delayed data? And which one should you choose? We'll go over the key benefits of using real-time data because - hint hint - that's the best choice for most market professionals.

What is real-time market data?

Stock markets have been around for centuries. However, after several inventions such as the phone and the internet, a lot changed. Suddenly traders had access to real-time market data. Real-time market data is when information about trades and prices is accessible almost instantly after an event takes place.

Because of these changes, things like electronic markets and automated execution orders are now normal. All these innovations support a growing international market economy and have led to an increasing amount of daily generated data.

Having an abundance of data can obviously be helpful. It provides brokerages and traders with information that enables them to make well-informed choices on whether or not they should go ahead with a transaction.

But processing large amounts of data in a short amount of time is also challenging. Because of this, a lot of the work that brokerage companies and traders do is based on automated data processing and analysis. The interpretation of this amount of data can result in great gains but also losses. Having access to accurate, reliable, and current market data can decide your outcome.

Access to real-time market data

Not everyone has access to current quote data, better known as real-time market data. Investment news websites or trading platforms, for instance, display delayed data. Delayed data can be a few minutes to twenty minutes behind. So why is that?

As is usually the case, valuable information is expensive. If you want access to accurate, up-to-date data, you have to pay a provider that can give you access. Before these providers can get you what you need, they need to pay their own licensing fees. If they collect data from multiple providers, they even have to pay multiple licensing fees. On top of that, when the data is distributed, even additional fees are common. All of this results in even higher licensing fees.

Depending on the type of trading you do, though, the ability to respond to even small market fluctuations is necessary to generate profits. In that case, access to accurate and current data is essential and worth the investment.

Benefits of real-time market data

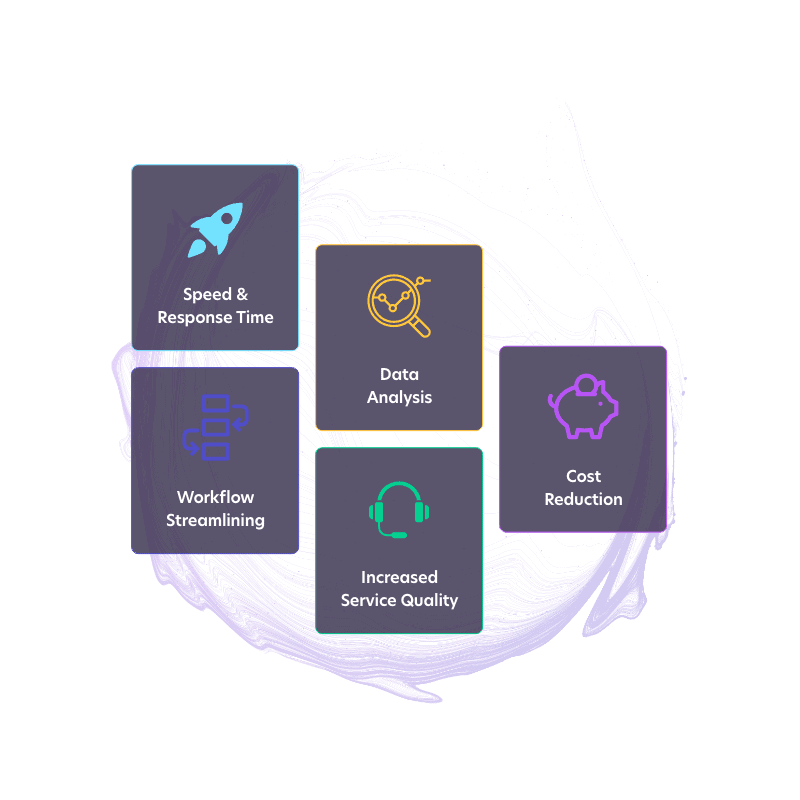

Access to market data creates opportunities. Still, the use of reliable real-time market data can be of even greater benefit. While every company or organization has its own specific needs, several core advantages generally apply.

1. Speed and response time

The most obvious advantage of using real-time market data is the short response time. Changes occur continuously, and unexpected shifts can have a ripple effect. In markets where changes can happen within seconds, a twenty-minute delay is significant.

An example of an unexpected change that created headlines worldwide is what happened with GameStop in January 2021. Within a day, the stock value went through the roof. Big trading firms, freelance traders, and even first-timers who had access to trading apps joined in. This explosion of interest created very rare fluctuations in stock prices, and every second you were behind could mean millions in losses. Because it was not just GameStop that was impacted, quick responses were needed to contain the ripple effect. Traders who had shorted the GameStop stock had to respond right away to salvage what they could while at the same time try to use the ripple effect to their advantage.

Even though this was not a typical situation, it is a good illustration of how the stock market does not exist in a vacuum. Predicting the market is always challenging, but cases like this show how volatile seemingly stable stock prices can become.

2. Workflow streamlining

The absence of lag does more than shorten response times. It positively impacts many aspects of the workflow. An example of this is risk assessment management. Real-time market data helps to reduce risks and can increase accuracy, which in turn leads to an all-over higher efficiency. Investors, advisors, and asset managers can better understand current risks and opportunities while they are aware of market regulations.

3. Data analysis

As we briefly mentioned earlier, brokerage companies and traders analyze data so they can make well-informed decisions and make a move before their competition does. Analyzing data in this day and age, however, is easier said than done. Financial markets have expanded a lot but so have the number of factors that influence them.

Social media, for instance, is an unpredictable force that can change the public perception of a person or company. We have all seen examples of people who got canceled but were also associated with a company. How companies handle such a situation directly affects what the consequences are on the stock market. Making sure that data analyses are done in real-time while a company is responding gives brokerage companies and traders an advantage.

4. Increased service quality

The use of real-time market data is not only a direct advantage. When you work with reliable and accurate data, companies can provide a better and more reliable service to their customers. Depending on the types of services a company offers, responding more accurately and quicker than a competitor who works with delayed data, can create an elevated customer service experience.

5. Cost reduction

There are many advantages to using real-time market data and they all help you reduce costs. Depending on the average price for licensing though, it is difficult to estimate the impact on your bottom line. Nevertheless, when sourced the right way, licensing only costs a fraction of the price that legacy systems demand.

Don’t settle for high licensing fees

The licensing fees that you need to pay to access real-time market data are high. Because of this, many small-time traders decide that the fifteen to twenty-minute delay is acceptable. For brokerage firms with high-volume trading efforts, it’s another story. Every delayed minute can cause them a big financial loss. Fortunately, we’ve got a solution that fits all types and sizes of trading capacities!

Real-time market data at a fraction of the cost

United Fintech offers reliable and accurate data for a fraction of market conform prices. A variety of packages is available that include equities, indices, futures, commodities, crypto, and FX pairs.

We gather data from most essential financial exchanges, leading financial institutions, and trading platforms. Subsequently, the data is collected on a tick level and constantly compared to trade pricing and reliable quotes at ten updates per second per instrument.

Additionally, the services that include high data quality at great flexibility can be used in multiple applications that range from internal risk management to mobile apps. The easy-to-use IT platform supports not only real-time market data but also historical data time series.

Check out United Fintech’s real-time market data solutions for more information or book a call with one of United Fintech’s market data experts.

Heading

We turn bold ideas into measurable results. By combining insight, execution, and technology, we deliver solutions that make transformation not just achievable, but repeatable.