A Single Point of Failure (“SPoF”) in FX post-trade messaging, created by decades of market consolidation, poses a significant threat to the entire global financial ecosystem says industry veteran Andy Coyne of CobaltFX, voicing his concerns as the British fintech launches the world’s first alternative post-trade messaging service in efforts to de-risk FX and deal with “Hobson’s Choice” in the world’s effectively largest market.

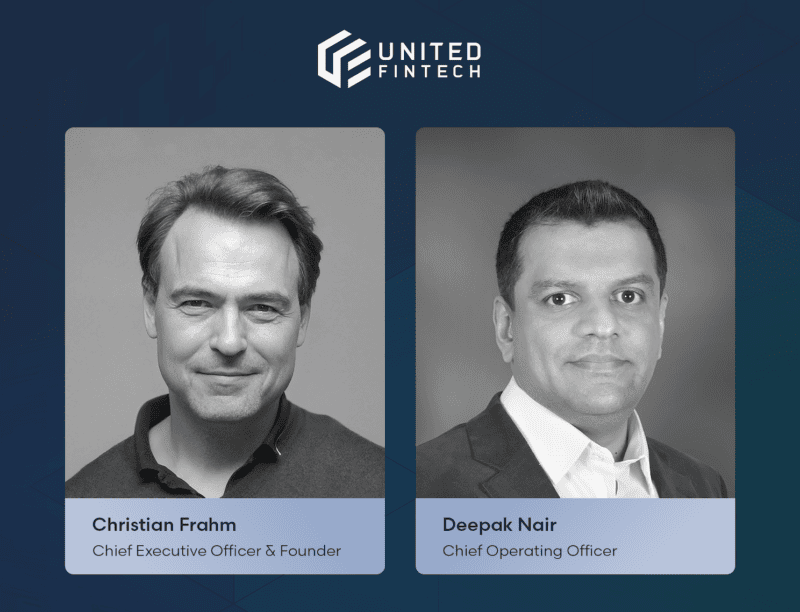

For far too long, the financial industry has grappled with lack of competition for FX post-trade messaging stemming from decades of industry consolidation; an issue having grown into a problem that today represents one of the most significant threats to the global financial ecosystem. In a nutshell, this is the brief assessment of Andy Coyne; a seasoned industry expert and founder of CobaltFX, today part of United Fintech, whose past tentures include executive positions with major global banks and FX fintechs alike.

For the uninitiated, post-trade messaging is the digital exchange of real-time and critical trade confirmations between financial counterparts enabling the multi trillion-dollar a day FX industry. And according to Andy Coyne, there exists a number of core improvements that have long been overdue -notably that execution messages need alternative solutions that can run free of charge- that CobaltFX has set out to fix with a new Trade Notification Network (“TNN”) launching November 7 in response to growing concerns amongst financial institutions about Single Points of Failure (“SPoF”) across the industry, reports Coyne:

“Recent incidents, such as consolidation and a hack that disrupted market operations earlier this year, have raised concerns among major global banks about the inherent risks associated with SPoFs in FX operations and this has been a major call to action for us in launching the TNN. Further to that, we strongly believe that post-trade messaging is not a service that should be charged for. In the 21st century, messaging should be free and only value added services that use that data should be chargeable”, says Andy Coyne.

Breaking with industry “Hobson’s Choice”

Andy Coyne warns that the potential consequences of e.g. a catastrophic cyber security scenario are far more severe than what is currently being reported publicly by financial institutions and industry observers alike, as many of the world’s largest banks are currently overexposed, leaving them vulnerable without an alternative or backup plan.

To address the issue in the FX industry, CobaltFX’s launch of the TNN will provide banks with a genuine choice in post-trade FX messaging and backup plan in the event of cyberattacks or other forms of failure in the FX market – and essentially enable the industry to break free of the “Hobson’s choice” it has been caught-up in for decades, argues Coyne:

“The FX market, by sheer trading volume, is amongst the world’s largest markets, making the need for comprehensive solutions even more pressing. Imagine if banks’ only messaging network all of a sudden came to a halt amid FX trading; this could stop trading completely. The introduction of the TNN is poised to eliminate the “Hobson’s choice” that has defined the FX industry’s service offering until now. It represents a significant step forward in bolstering the industry’s resilience against systemic risks – and by effect the safeguarding of the entire financial ecosystem”, says Andy Coyne, noting that the threat of SPoFs should be a wake-up call for the financial sector to assess industry-wide – and not just in FX.