Australia and New Zealand Banking Group (ANZ) has joined CobaltFX’s Dynamic Credit platform to manage credit exposure for FX trades on interbank trading venues.

ANZ’s adoption of the platform demonstrates their view on the importance of a real-time, centralised FX credit management system, managing multiple trading venues from a single central global limit set, and using dynamic distribution of credit availability. ANZ is the latest among a group of forward-thinking institutions seeking greater control, efficiency, and an alternative to outdated market access methods.

David Thorne, ANZ Head of eFICC Europe and North America commented: “This new approach to credit management has helped eliminate carve-outs as well as reduce credit usage while improving our market access. This capability benefits our customers, counterparties, and the bank.”

Darren Coote, CEO of CobaltFX expressed: “It’s a pleasure to welcome ANZ to the CobaltFX community of market leaders who are dedicated to transforming the nature of the FX market by reducing risk and enhancing market access for all.”

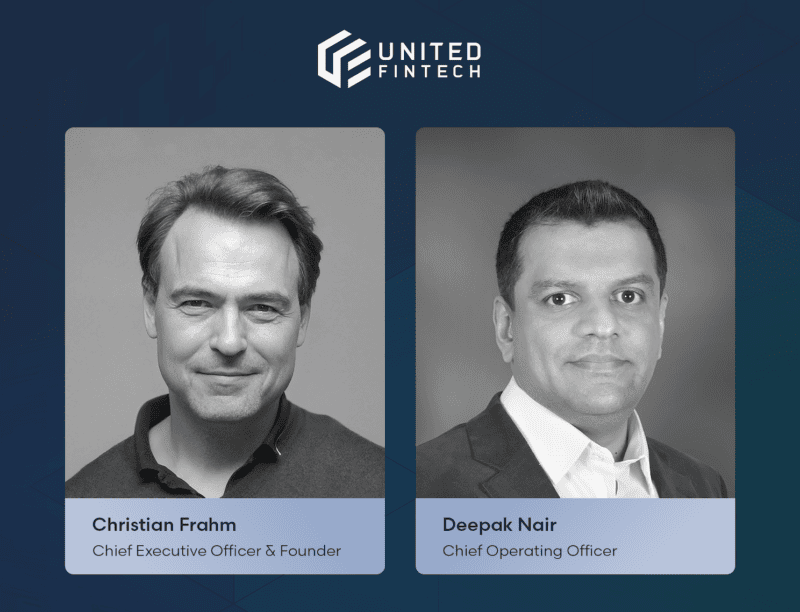

CobaltFX, part of United Fintech, is a leading provider of fully automated pre and post-trade infrastructure empowering global financial institutions to access deeper liquidity while deploying less credit, and minimising operational risk. CobaltFX continues to enhance its platform, focusing on ways to make market access easier and to reduce risk among all members of the group.